TOP STORIES

-

LATEST: Think you’re paying less tax now? The withdrawal of Working and Child Tax Credits leaves low earners paying a 73% marginal tax rate, and medium earners paying even more

...And this government says it cuts taxes for poor working households!

-

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST WEEK'S MEDIA

Drug firm Novartis tried to 'scupper' trials of a cheaper version of eye medicine

Has Austerity caused the UK’s first decline in life expectancy in 20 years?

Kellogg's effectively paid no corporation tax in the UK in 2013, +more stories...

-

YOU'RE FIRED?! We are already nearly the most easily fired people in the developed world

Only the US and Canada make it easier, says the OECD’s Worker Protection Index -

EYE OPENER: Housing Equity Withdrawal took off in 1979. Since then almost all UK growth has suspiciously equalled the amount we took out. Looks like it’s pensions next

Osborne’s new rules allow you to spend your entire pension pot now. Same mistake, different pot -

DID YOU KNOW? MPs are getting a 10% pay hike in May, to £74k

...and in 2010, 137 MPs put family members on parliament's payroll. Now it's soared to 167

CARTOONS

Friday, 29 July 2011

Friday, July 29, 2011

Posted by Jake

No comments

Labels: benefits, budget cuts, Cameron, credit crunch, inequality, jobs, MP, OFT, pay, regulation, Vince

Wednesday, 27 July 2011

Wednesday, July 27, 2011

Posted by Jake

No comments

Labels: banks, credit crunch, inequality, police, protests, the courts, UK Uncut

Friday, 22 July 2011

Friday, July 22, 2011

Posted by Jake

2 comments

Labels: benefits, credit crunch, energy, inequality, Inflation, OFGEM, politicians, regulation

Wednesday, 20 July 2011

Wednesday, July 20, 2011

Posted by Jake

No comments

Labels: advertising, OFT, regulation, sales techniques, taxation

Monday, 18 July 2011

Monday, July 18, 2011

Posted by Jake

No comments

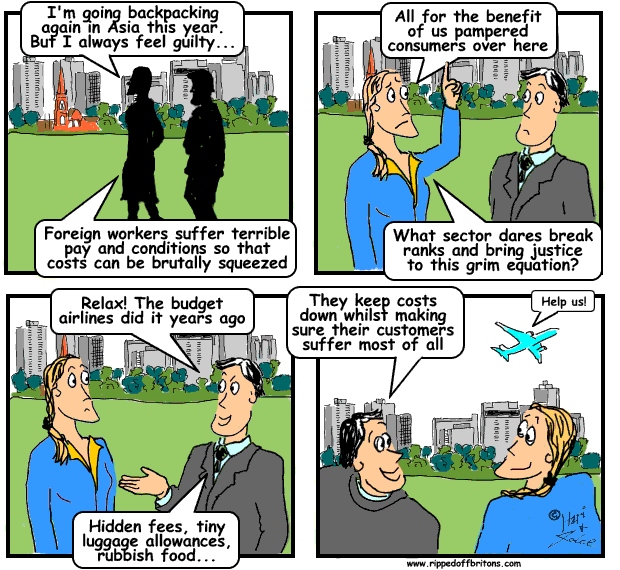

Labels: advertising, Inflation, leisure, pay, transport

Sunday, 17 July 2011

Continuing from last week's post on energy bill rip-offs, according to the International Energy Agency, Britain is 68.7% self-sufficient in Natural Gas. And yet hikes in our gas and electricity bills over the last few years outstrip those in countries with virtually no reserves. Why is that?

In its Retail Market Review of March 2011, OFGEM observed that the suppliers’ behaviour continued to deteriorate when it came to pricing:

Ofgem, like a disappointed but indulgent primary school teacher, gently reproves the utilities with words such as

“It has come to our attention that suppliers may not be conducting due diligence while executing some of the new provisions of SLC**. Therefore, we have decided to issue this guidance to help clarify certain issues.”

Given the history of the marketing licence condition and the extensive consultation exercises previously carried out (e.g. during the Probe), Ofgem firmly takes the view that suppliers should already be fully aware of, and fully capable of understanding, the spirit and letter of the obligations contained in SLC **.

In the absence of exceptional circumstances or compelling evidence of genuine uncertainty, Ofgem is unlikely to consider it appropriate to provide any additional clarification on SLC **.

It remains the responsibility of suppliers to ensure compliance with all licence conditions and relevant provisions of consumer protection law.”

In summary, this says:

a) We know you are doing the wrong thing.

b) We’ve already told you what the right thing is.

c) We know you know what the right thing is.

d) We’re not going to tell you again.

e) You should be doing the right thing.

f) Erm… that’s it. Yours Sincerely etc.

If you want to know whether companies are profiteering, don’t look at the statements they make to the regulators and the public – which will all be hand-wringing stuff about how their own costs are so high - but look at what they say to their investors. Centrica, in its 2010 Annual Report, stated that since the previous year its operating profits had jumped by 29%, from £1.9 billion to £2.4 billion. British Gas, part of Centrica, contributed a 24% jump in profits to £742 million.

Centrica, owner of British Gas and one of the largest suppliers of gas and electricity in the UK, provided the following information in its 2010 Annual Results:

The contribution of the Downstream business, which sells the energy to households and businesses, breaks down like this:

Between 2009 and 2010, Centrica reported the following increases in its retail business

· Customers - up 2% (from 25.2 million to 25.7 million)

· Gas supplied - up 3% (from 14.1 billion therms to 14.6 billion therms

· Electricity supplied - up 1% (from 44.5 thousand gigawatt hours to 45 thousand gigawatt hours)

And yet these small increases of between 1% and 3% in volumes resulted in a bumper 20% increase in profit. Which could only be achieved by bumper price rises.

For the full bonus to be paid, EPS needs to grow 30% faster than inflation. For the executives to get their money, Centrica’s negligible increase in market share seen in the annual report needs to be compensated for by an increase in profit margin.

All the companies, the Big Six and the small middle-men, rely on customer confusion to maintain their market shares. Statements made by three energy companies in response to a BBC Watchdog program in October 2009 titled “Why haven’t energy prices come down?” all manage to claim they are the cheapest, one way or another:

· British Gas –

o “I would point out that we were the first of the "big 6" to cut prices this year and also had the biggest cuts”

· EDF Energy –

o “EDF Energy is currently the cheapest supplier among the big 6 both for a typical dual fuel standard credit customer and dual fuel prepayment customer based on a national average across all regions”

· Scottish Power –

o “Our Economy 7 rates are the cheapest in the market for prepayment, direct debit and prompt Cash Quarterly.”

A really paranoid person might think these companies share out the accolades: I'll have the biggest cut in price, you can do the lowest Economy7, and he can have the top-spot for duel-fuel. Everyone has something to boast about, and can still keep up the ripping.

One of the important services the energy companies provide is supplying power to keep us warm in the winter, and cool in the summer. They can also achieve this without delivering a single kilowatt of power. Simply take a look at Centrica’s 2010 Interim Results presentation, and any Ripped-Off Britons worthy of the name would get hot (under the collar) and chilled (to the bones): “Aim to double operating profit over the next 3-5 years”! Help!

One of the important services the energy companies provide is supplying power to keep us warm in the winter, and cool in the summer. They can also achieve this without delivering a single kilowatt of power. Simply take a look at Centrica’s 2010 Interim Results presentation, and any Ripped-Off Britons worthy of the name would get hot (under the collar) and chilled (to the bones): “Aim to double operating profit over the next 3-5 years”! Help!Ordinary Britons are on the whole painfully reasonable people. If we possibly can, we tend to give the benefit of the doubt when we are ripped-off and take the pain ourselves. Scammers rely on this – where there is uncertainty and confusion there is resigned tolerance. Without a forensic examination we can’t be sure whether that choking gas bill was because we left the thermostat too high a month ago. Or maybe we can do something about the shocking electricity charges by running the washing machine at night during off-peak hours. If at all possible, we put the blame on ourselves. Why do we do this? Because in the synchronised pricing of the Big 6, and the indolence of OFGEM, what alternative do we have?

Friday, 15 July 2011

Friday, July 15, 2011

Posted by Jake

No comments

Labels: budget cuts, inequality, jobs, leisure, media, pay, police, politicians, taxation

Wednesday, 13 July 2011

Wednesday, July 13, 2011

Posted by Jake

No comments

Labels: energy, environment, OFGEM, OFT, politicians, regulation, taxation

Monday, 11 July 2011

Monday, July 11, 2011

Posted by Jake

No comments

Labels: credit crunch, energy, inequality, OFGEM, OFT, politicians, regulation

Sunday, 10 July 2011

Sunday, July 10, 2011

Posted by Jake

1 comment

Labels: Article, energy, Inflation, Liebrary, OFGEM, politicians, regulation

British Gas announcing a second price rise for the year, blaming increases in wholesale energy prices, brings to mind a classic scene from one of the great detective novels:

Gregory (a cop): "Is there any other point to which you would wish to draw my attention?"

Holmes: "To the curious incident of the dog in the night-time."

Gregory: "The dog did nothing in the night-time."

Holmes: "That was the curious incident."

Sherlock Holmes, Victorian consulting detective, noted that the dog didn’t bark when the bad guy went past, deducing that the villain was friendly with the dog. Elegant stuff. I wish I’d written it – so I will.

OFGEM (a cop):“Is there any other point to which you would wish to draw my attention?”

Hari&Jake: “To the curious movement of the wholesale gas price over the last couple of years

OFGEM: [wiping drool from chin with elegant silk handkerchief] “The gas price has done nothing since it collapsed in 2008-09.”

Hari&Jake: “That was the curious movement.”

Hari&Jake, Elizabethan cartooning bloggers, noting that the poodle didn’t bark when the bad guys hiked the cost of domestic energy bills, wonder whether the villains may possibly be friendly with the dog.

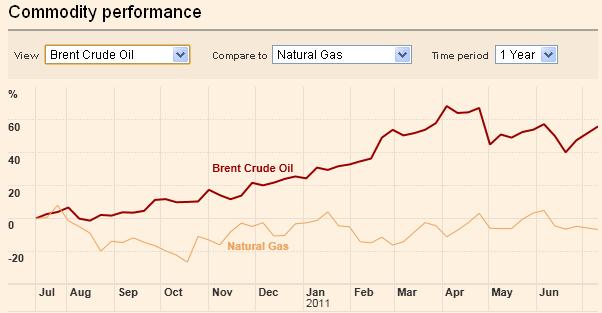

Everyone knows that the oil price has been very volatile for many years because of things like instability in foreign lands. Oil and Gas go together like Ripped-Off and Briton, right? The assumption is that as goes oil, there follows gas. After all, they are both made of decomposed prehistoric organic matter.

But, actually, the price of gas doesn't follow that of oil. Not even remotely.

This chart from the Financial Times compares prices over one year.

And the reality is, although the wholesale oil price is now nearly five times what it was ten years ago in 2001, the wholesale gas price is actually lower than it was in 2001!

This chart from the Financial Times compares prices over one year.

And the reality is, although the wholesale oil price is now nearly five times what it was ten years ago in 2001, the wholesale gas price is actually lower than it was in 2001!

But what of the price of oil, which has clearly shot up? Gas is gas, but electricity needs to be generated. Could the price of oil be pushing electricity bills up?

Again, the answer is "no".

In the UK the great majority of electricity is generated by gas and coal. According to the Department of Energy and Climate Change (DECC), oil represents a tiny 2% of the fuels used to generate electricity for the UK domestic market.

Again, the answer is "no".

In the UK the great majority of electricity is generated by gas and coal. According to the Department of Energy and Climate Change (DECC), oil represents a tiny 2% of the fuels used to generate electricity for the UK domestic market.

The data shows there is virtually no link between the wholesale price of oil or gas and UK household energy bills, except in the mendacity of the energy companies and the incomprehension of OFGEM.

The US Energy Information Administration provides data for domestic energy prices in various countries between 2001-2008, shown in the graph on the right. With all the earnest excuses from British Gas and chums, who claim international wholesale prices force them to put up their charges, countries other than the UK and Ireland have managed to raise prices much less.

While electricity generation in France has a heavy reliance on nuclear power, the fuel mix for Spain is very close to the UK. And a gas supply is all gas.

While electricity generation in France has a heavy reliance on nuclear power, the fuel mix for Spain is very close to the UK. And a gas supply is all gas.

A more complete set of data is available from the UK’s Office of National Statistics, showing the growth in domestic energy prices up to April 2011. Demonstrating that while the wholesale gas price has returned to below its 2001 level, domestic energy bills have continued to soar.

Life is full of surprises. But few come from the energy sector:

- British Gas' claim that the 25% increase in domestic energy bills over the last year is due to soaring wholesale fuel prices is neither true nor surprising.

- Thinking they could get away with it is even less surprising.

- That they actually do seem to be getting away with it is least surprising of all.

What would stop them? Get the evidence in front of as many people as possible - bloggers, tweeters, casual conversations, irate rants.

And when you've got that out of your system, browse our Liebrary for other things to really annoy you.

And when you've got that out of your system, browse our Liebrary for other things to really annoy you.

Wednesday, 6 July 2011

Wednesday, July 06, 2011

Posted by Jake

No comments

Labels: insurance, pensions, property, taxation, the government

Monday, 4 July 2011

Monday, July 04, 2011

Posted by Jake

No comments

Labels: benefits, budget cuts, housing, inequality, property

Sunday, 3 July 2011

Sunday, July 03, 2011

Posted by Jake

10 comments

Labels: Article, banks, benefits, Big Society, budget cuts, inequality, jobs, pay, pensions

According to the Department of Works and Pensions, the official poverty line for pensioners with no dependent children is

Single Person: £166 per week

Couple: £248 per week

According to the Hutton report on public sector pensions, the median pension (i.e. the amount that half the people in the group get less than) for Local Government workers and for NHS staff places them in poverty. This is even after receiving the State Pension on top of their ‘gold plated’ occupational pensions.

That puts 790,000 Local Government and NHS pensioners in poverty. The Hutton report also shows that a further 750,000 public sector pensioners are no more than £50 a week above the poverty line.

The government is trying to take money from hundreds of thousands of Britons who are in or near poverty, to fix the crisis caused by bankers who are rolling in it. Why are MPs so heartless? As public servants, do they not feel the same pain from these severe public sector pension downgrades?

Actually, they don’t. For two main reasons

a) Their own magnificently subsidised pensions

b) Their remunerated hobbies

MPs' Pensions

MPs have three options for growing their pensions. They can get...

One-fortieth of their final salary for each year of service, by contributing 11.9% of their salary

One-fiftieth of their final salary for each year of service, by contributing 7.9% of their salary

One-sixtieth of their final salary for each year of service, by contributing 5.9% of their salary

The taxpayer (described rather coyly as "the exchequer") tops up their contributions at the rate of 31.6% per year. This compares with about 14% for the teachers and NHS pension schemes.

At current salaries, using the “1 fortieth” rate, an MP adds £1,643 per year to his pension for each year he works as an MP, equivalent to £137 per year to his pension for each month he works.

Single Person: £166 per week

Couple: £248 per week

According to the Hutton report on public sector pensions, the median pension (i.e. the amount that half the people in the group get less than) for Local Government workers and for NHS staff places them in poverty. This is even after receiving the State Pension on top of their ‘gold plated’ occupational pensions.

That puts 790,000 Local Government and NHS pensioners in poverty. The Hutton report also shows that a further 750,000 public sector pensioners are no more than £50 a week above the poverty line.

The government is trying to take money from hundreds of thousands of Britons who are in or near poverty, to fix the crisis caused by bankers who are rolling in it. Why are MPs so heartless? As public servants, do they not feel the same pain from these severe public sector pension downgrades?

Actually, they don’t. For two main reasons

a) Their own magnificently subsidised pensions

b) Their remunerated hobbies

MPs' Pensions

MPs have three options for growing their pensions. They can get...

One-fortieth of their final salary for each year of service, by contributing 11.9% of their salary

One-fiftieth of their final salary for each year of service, by contributing 7.9% of their salary

One-sixtieth of their final salary for each year of service, by contributing 5.9% of their salary

Overall, as a herd, MPs contribute a little under 10% of their salaries.

At current salaries, using the “1 fortieth” rate, an MP adds £1,643 per year to his pension for each year he works as an MP, equivalent to £137 per year to his pension for each month he works.

So, at this rate of growth, how long does it take an MP to build up a pension equal to the average (median) pension of various public sector workers? (PCPF=Parliamentary Contributory Pension Fund)

Local government worker: £3,048 2 years 3 months

NHS worker: £4,087 3 years 6 months

Civil Servant: £5,023 4 years 1 month

So in less than the life of one single Parliament the MPs would be better off than one million public sector pensioners, from whom they intend to take money.

“According to evidence from the Government Actuary’s Department (GAD), the mean length of service (excluding transfers in and added years) of active PCPF members at the time of the latest valuation in 2008 was 12.2 years, while the mean length of service (again excluding transfers and added years) of those who left at the election in 2005 was 14.4 years.”

With 14.4 years service an MP could build up a pension worth £23,500 per annum at current salary figures. This pension is index linked to RPI, and provides five eighths of the amount to the widowed spouse after the MPs death. According to the FSA’s moneymadeclear.org.uk website, you would need a fund of about £700,000 to buy this annuity from the likes of Aviva, Legal & General, and the Prudential insurance companies.

MPs remunerated hobbies

MPs don’t have to rely on their parliamentary pensions. MPs claim that their jobs are so very demanding, using this as a reason to push up their pay and perks, and a justification for pinching expense money. And yet these same MPs find time for other jobs.

The Members' Register of Interests show MPs find time for other well remunerated activities. Let's randomly look at MPs whose surnames begin with "M":

Francis Maude: (currently pushing through the public sector pension cuts)

was paid £9,203.23 for 15 hours work on a Barclays Bank advisory board.

Alan Milburn: (Former member for Darlington, and former Health Secretary)

Member of Lloydspharmacy's Healthcare Advisory Panel. (£25,001-£30,000) Remuneration paid annually.

Member of European Advisory Board of Bridgepoint Capital Limited. (£30,001-£35,000) Remuneration paid annually.

Member of the Advisory Board of PepsiCo UK. (£20,001-£25,000) Remuneration paid annually.

Andrew Mitchell: (Sutton Coldfield)

Paid £14,375 (inclusive of VAT) for 24 hours work as Supervisory Board member.

Paid £10,350 (inclusive of VAT), for 10 hours for management consultancy work

In 2010 three MPs, Geoff Hoon, Stephen Byers, and Richard Caborn, were caught out peddling influence by the Channel 4 “Dispatches” programme. Byers commented “I am a bit like a cab for hire”. The daily rate of £5,000 per day seems to be pretty consistent, whether advising a bank or being a cab for hire.

In a day an MP can earn more than the annual pension of 1 million public sector workers. Cutting public sector pensions? A politician will grasp at any straw so long as it is someone else drowning.

A few years ago, during the last Labour government, another Lord reviewed pensions. Lord Turner came up with proposals with many similarities to those of Lord Hutton. Broadly speaking, there is not much practical difference between the intentions of the Labour and the Conservative leadership.

Not only did Lord Turner make recommendations on pensions, including pushing up the retirement age, he also spoke frequently about the Financials Services industry and the City:

“I suggested that some of the activities which went on in the trading rooms of some banks in the run up to the financial crisis were ‘socially useless’. People have asked me whether I regret those comments. The answer is no, except in one very small respect. Which is that I think it would have been better to use the phrase ‘economically useless’”

So why is the government so determined to take money from the poor, and ignore this handsome stash of guilty cash? After all, the City is the central player responsible for our current financial crisis. The excessive costs for financial services – including the pillaging of pensions by high charges – drain our money futilely (no link between pay and performance) into excessive pay for bankers? The £2.5 billion bank levy is small beer put next to the amounts paid in bonuses. There is a lot more where that came from.

As Mervyn King, governor of the Bank of England, stated:

Friday, 1 July 2011

Friday, July 01, 2011

Posted by Jake

No comments

Labels: budget cuts, credit crunch, education, inequality, MP, pay, pensions, politicians, protests, public sector

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

Priority

property

protests

public sector

Puppets

Ready

regulation

retailers

Roundup

sales techniques

series

SFO

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

UK Uncut

unions

Vince

water

Archive

-

▼

2011

(185)

-

▼

July

(15)

- Steve Hilton's blue-sky thinking

- Kicking up a fuss over cuts

- Central heating or food - you won't have both if y...

- Where there's a Will there's a way of making money

- Budget airlines: bringing equality to an unequal w...

- Electricity and gas bill ripoffs - to see what is ...

- Parliament interrogates Murdoch

- Huhne energy blackout

- A winter of discontent

- Liebrary: British Gas' claim that wholesale energy...

- Law-breaking news

- Retirement plans

- Affordable housing … but only for a few

- Public sector pensions – a politician will grasp a...

- MPs: Do as we say on pensions, not as we do

-

▼

July

(15)

Powered by Blogger.