News has to be new. Rip-off organizations rely on this. When they are caught red-handed, as they frequently are, their scams make the news for a few days. When the novelty has worn off, the story disappears. Leaving the rippers-off ripping, the news moves on to new stuff.

The realization that a Dutchman gets 40% more pension than an Englishman for the same investment made the news in December 2010, but has since been forgotten. Leaving the pension companies to continue ripping-off Britons with high charges and rubbish annuities, consigning many to poverty stricken old-age.

It is when the story is no longer ‘news’ that the real ripping happens. Under the cover of ‘business as usual’ - which, sadly, for many organisations is exactly what ripping-off is. Business as usual.

The FSA, OFGEM, and others have regretted the failure of those they regulate to learn from past mis-selling. Hector Sants, chief executive of the FSA, said in a speech in June 2011:

I would like to take the opportunity to make some personal remarks on the challenges the FCA faces.

''The biggest disappointment of my time at the FSA has been the failure of firms, in particular their senior management, to learn the lessons of past mis-selling. Sadly the recent history of the British retail financial services industry is proof of the adage that those who fail to understand the mistakes of the past are condemned to repeat them.''

Hector Sants, CEO of the FSA, 28th June 2011

If the rippers-off fail to learn, then the next best thing is for us ripped-off Britons to learn.

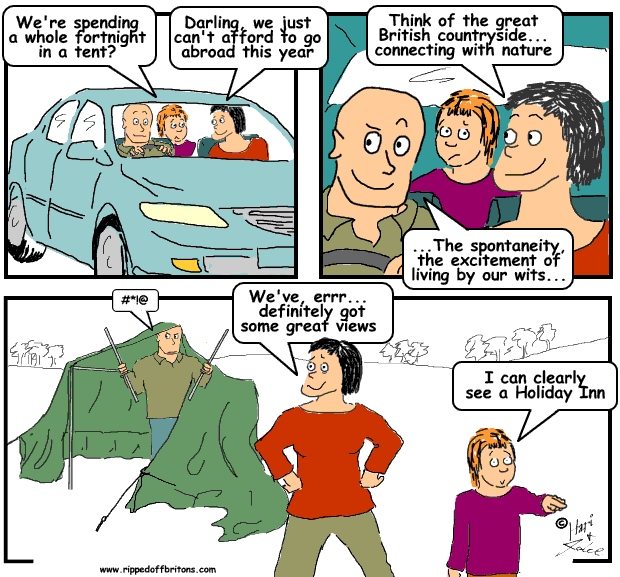

Looking back over the first half of this year, our articles and cartoons have shown where companies and government have sought to rip us off. We devote this post to reminding you.

To help, we have categorised the rip-offs:

Banking Scams: Excessive charges; Bonuses; Dodging jailtime; Puny regulation; Minimal fines; Fraud...

Government Scams: Pensions; Benefits; Tax avoidance; Inflation; Public Spending; MPs...

Government Scams: Pensions; Benefits; Tax avoidance; Inflation; Public Spending; MPs...

Pensions rip-offs: Charges draining pensions; Rubbish annuities; The trick of inflation..

Gas & Electricity Bills rip-offs: Excessive bills; The lack of linkage between wholesale and retail prices

Targeting the vulnerable: Tricking, misleading, and why in Britain it is legal.

The Liebrary: Well used lies exposed.

- Bankers escape punishment for their misdeeds: Neither admit nor deny wrongdoing - when nobody is responsible, anything is acceptable

- Evidence from company accounts that bonuses are paid for mediocre performance: Pay for performance – Lloyds, RBS, Annual General Meetings and UK Government cowardice

- Banks trick customers into handing over their dividends: Beware bankers bearing Structured Products – the Great Dividend Robbery

- Banks fight to the last to get away with PPI rip-off: Payment Protection Insurance: bankers appeal to protect their right to do wrong

- The scam of dropping interest rates: Cash ISAs: How banks can pinch 92% of your savings income, and the OFT says it's ok

- Confirmation that fines are a fraction of ill-gotten gains: Regulatory Fines – the most lucrative investment a bank (or any financial services company) can make

- The problem with the banks is not the level of bonuses, but the level of profits that pay for the bonuses: Take care of excessive banking profits, and the excessive bonuses will take care of themselves.

- How pay has spiraled, inspite of mediocre returns: Who pays for the "top talent"?

- Excessive bonuses: Cuckoos In The Nest Egg - As we approach Banking Bonus Season, consider how top bankers manage to pay themselves so magnificently, and get away with it.

- Evidence to the contrary: Liebrary: Massive bonuses incentivise fund managers to perform consistently well

- Evidence to the contrary: Liebrary: If bank regulation were anything other than 'light touch' then companies would move to other jurisdictions. This would have a catastrophic impact on taxes

- Evidence to the contrary: Liebrary: Financial Services corporation tax makes a major contribution to overall UK tax

Government Scams

- Public sector pensions: a politician will grasp at any straw so long as someone else is drowning

- Benefits Fraud: would the taxpayer save money by giving every citizen their due, not a penny more, not a penny less? Actually, it would cost £12.7 billion EXTRA!

- Inflation: How "the price of this financial crisis is being borne by people who absolutely did not cause it"

- Election reform: Forget ELECTION reform! It is EJECTION reform that really matters

- Corporation Tax: “A fat policeman chasing a speeding Ferrari” – Her Majesty’s Taxmen versus corporate tax departments

- Parliamentary Expenses: Westminster Gravy Train's return journey

- Public spending cuts: how the poor subsidise the rich

Pensions rip-offs

- The effect of inflation: Pensions – the monstrous truth about the inflation indexation change from RPI to CPI

- Annuity Scams: Pensions - having already swiped 50% of your savings in charges, how pension providers grab another 20% from you with your annuity

- Excessive charges: Pensions - how fund management charges swipe 50% of your pension

Gas and electricity bill rip-offs:

- Energy company bonuses and profits: Electricity and gas bill ripoffs - to see what is happening, look at the company accounts

- What's happening to wholesale energy prices?: British Gas' claim that wholesale energy price is pushing up bills is not true: the evidence

Targeting the vulnerable

- Spending by the poor: Why companies don't just target the rich - because the poor have most of the cashflow

- The Consumer Protection Act: The law that makes it quite legal to rip off 50% of Britons

- A good salesman: Why we should love Estate Agents

- Who really gets the money?: Fairtrade - the good reason, and the real reason

- Companies' excuses: From tobacco to banks to television - don't blame us, its all been a horrible misunderstanding.

- The law lets off the bad guys: Wishing you a better new year than the last one.

The Liebrary

- Evidence to the contrary:Liebrary: Massive pay packages compensate CEOs for the high price for failure

- Evidence to the contrary:Liebrary: Massive bonuses incentivise fund managers to perform consistently well

- Evidence to the contrary: Liebrary: If bank regulation were anything other than 'light touch' then companies would move to other jurisdictions. This would have a catastrophic impact on taxes

- Evidence to the contrary: Liebrary: Financial Services corporation tax makes a major contribution to overall UK tax