TOP STORIES

-

LATEST: Think you’re paying less tax now? The withdrawal of Working and Child Tax Credits leaves low earners paying a 73% marginal tax rate, and medium earners paying even more

...And this government says it cuts taxes for poor working households!

-

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST WEEK'S MEDIA

Drug firm Novartis tried to 'scupper' trials of a cheaper version of eye medicine

Has Austerity caused the UK’s first decline in life expectancy in 20 years?

Kellogg's effectively paid no corporation tax in the UK in 2013, +more stories...

-

YOU'RE FIRED?! We are already nearly the most easily fired people in the developed world

Only the US and Canada make it easier, says the OECD’s Worker Protection Index -

EYE OPENER: Housing Equity Withdrawal took off in 1979. Since then almost all UK growth has suspiciously equalled the amount we took out. Looks like it’s pensions next

Osborne’s new rules allow you to spend your entire pension pot now. Same mistake, different pot -

DID YOU KNOW? MPs are getting a 10% pay hike in May, to £74k

...and in 2010, 137 MPs put family members on parliament's payroll. Now it's soared to 167

CARTOONS

Tuesday, 31 January 2012

Tuesday, January 31, 2012

Posted by Jake

No comments

Labels: Big Society, Bonus, credit crunch, inequality, pay, UK Uncut

Sunday, 29 January 2012

Sunday, January 29, 2012

Posted by Jake

2 comments

Labels: Article, Big Society, Guest, inequality, taxation

By Richard Murphy, founder of the Tax Justice Network , director of Tax Research LLP, and author of The Courageous State*

Ed Miliband has announced himself in favour of good business. I am delighted he has. So am I. It’s astonishing that some are saying that by declaring himself against spivs, chancers, asset strippers, speculators and tax avoiders he is somehow anti-business. Far from it: he’s declared himself very pro-business precisely because it is these people who are anti-business.

But being anti-something is not good enough. Being pro-good business is what is required and that requires a clear understanding of just what a good business might be. I’m not seeking to offer a definitive guide here, but take these as examples. A good business:

- Makes clear who it is so people know who they are dealing with

- Makes clear who runs it

- Makes clear who owns it

- Makes clear the rules by which it is managed

- Puts its accounts on public record if it enjoys limited liability, and does so wherever it is incorporated whether required to by law or not

- Seeks to comply with all regulation that applies to it

- Seeks to pay the right amount of tax due on the profits it makes in the place where they are really earned and at the time they really arise

- Seeks to pay a living wage or more to all who work for it

- Recognises trade union rights

- Operates a fair pay policy so that the pay differential between highest and lowest paid in the company cannot exceed an agreed ratio that should never exceed twenty

- Makes fair pension provision for all employees

- Does not discriminate between employees on the basis of race, nationality, national origin, gender, sexual orientation, age, disability and similar such issues

- Does not abuse the environment

- Has a clear code of ethics that it publishes and is seen to uphold

- Is transparent in its dealings with customers

- Seeks at all times to minimise risk to those it deals with and takes all steps to ensure they know what those risks are

- Accepts responsibility for its failings and remedies them

- Works in partnership with its suppliers and does not abuse them

- Advertises responsibly

- Creates and supplies products meeting real human need

I could readily add to that list, which I do not think I have tried to prepare before. But the gist is obvious.

So what would this look like in practice, meaning how could this status be assessed?

This was a question I was asked by a councillor who wanted to put good ethics into practice in his council’s procurement policies.

This was a question I was asked by a councillor who wanted to put good ethics into practice in his council’s procurement policies.

I hope that the assessment criteria for the above should be clear in most cases with the exception perhaps if the fact that this list clearly implies the need for country by country reporting to explain:

- What it is called where it operates meaning it must name each subsidiary and specify where it operates

- Its profit and loss in each country and jurisdiction in which it operates

- How much tax is pays on the profits it earns in each jurisdiction

- What its internal trading is so that its transactions within its internal supply chains can be identified

- How many people it employs in each jurisdiction that operates in and how much it pays them in aggregate plus their pension cost

- How much it has invested in tangible assets and working capital in each jurisdiction on which it works.

Only then is the data to assess whether it is a good corporate citizen available for assessment.

The final part in this equation is suggesting an assessment criteria for what is a good company. In some cases this will, again, be obvious from the suggestions made. For example, it might be expected that a company either recognises a union or it does not. However things are rarely that simple. Different subsidiaries in different countries may or may not recognise unions so composite scores are possible.

Other indicators can be prepared using this data. For example explainable and unexplainable presence in tax havens becomes an issue when the number of subsidiaries in such places are known. The proportion of trade through or assets in such places also becomes significant assessment criteria if country by country accounting data is available. The likelihood of tax compliance can also be assessed properly when country by country reporting data is available.

‘So what?’ might then be the question. What would be the point of all this? Well when things are measured behaviour changes, we know that. But more significantly the government is a major purchaser from many companies. If its procurement policy was based on the requirement that a company meet a minimum standard or no contract could be issued then this becomes a very powerful tool indeed, and those criteria need not be consistent. So, for example, in the case of PFI offshore might simply be a non-starter.

The point though is this: we can identify good companies and the introduction of country by country reporting would make the whole task a lot easier.

What this means is simply this: reform to our currently unacceptable corporate culture is possible. All it takes is political will and we can do it.

Is that will available? That’s the question.

Second, having waited In vain for more than thirty years for someone to write an alternative economic theory to displace the neoliberal ideas that I think are fundamentally wrong, I have given up waiting and in the second part of the book I present a whole raft of new economic thinking that does, I hope, help explain the mess we’re in. I have heard so many say of late that what we really lack right now are alternative ideas to tackle our crisis when it is so obvious that existing thinking has failed.

*The Courageous State is my new book published in November 2011. I say three things in the Courageous State. First I argue that because the form of economics that has dominated government policy throughout the last thirty years in all major western countries, which is known as neoliberalism, has said that markets always get things right and we can’t beat them we have ended up with a generation of cowardly politicians who think anything they do will be worse than the market outcomes, so they choose to do nothing.

George Osborne’s walking away from the economy, saying all he can do is acquiesce to the demands of the bond market and deliver the cuts they expect, is perhaps the strongest evidence of this. I argue that this is wrong: I think that the state has a powerful role to play in our lives and our economy.

Second, having waited In vain for more than thirty years for someone to write an alternative economic theory to displace the neoliberal ideas that I think are fundamentally wrong, I have given up waiting and in the second part of the book I present a whole raft of new economic thinking that does, I hope, help explain the mess we’re in. I have heard so many say of late that what we really lack right now are alternative ideas to tackle our crisis when it is so obvious that existing thinking has failed.

I make no promise that I am right in what I say; that is for others to decide. But what I have most certainly done is offer economic theory quite different to just about anything you will have read before without, I would add, a single formula being used. There are, however, a lot of diagrams to help things along.

Finally, because I find books that offer lots of analysis and no solutions intensely annoying I do in the third part of the book present a whole new range of economic policy proposals that Courageous politicians could adopt to get us out of the neoliberal mess we’re in. There are six chapters devoted to that practical stuff.

The Courageous State can be bought from Amazon and is also available in Kindle format. It can also be ordered from any bookshop or you can order direct from the publisher – Searching Finance. Price £14.99 or less plus postage and packing.

Friday, 27 January 2012

Friday, January 27, 2012

Posted by Jake

No comments

Labels: leisure, OFT, protests, regulation, sales techniques, sports

Tuesday, 24 January 2012

Tuesday, January 24, 2012

Posted by Jake

No comments

Labels: benefits, Big Society, budget cuts, Cameron, HMRC, inequality, taxation, the government

Sunday, 22 January 2012

Sunday, January 22, 2012

Posted by Jake

No comments

Labels: education, Liebrary, retailers, sales techniques

But it is not enough to simply look for ludicrous interest rates to spot a rip-off. Being wicked doesn't make a chap stupid. And anyone who paid attention in that maths lesson about percentages back when they were teenagers would be able to come up with this scam. If the inclination, or rather the incentivisation, took them.

A report by Barnardo's, the childrens' charity, highlights how poor families are ripped off by extortionate credit charges. The report, "A vicious cycle: The heavy burden of credit on low income families" states:

"Barnardo’s has found that an individual could pay £780 more when buying through rent-to-own companies than through the high street.

In this example the person would face a premium of over £150 on the list price of a washing machine when purchased through rent-to-own. This is before interest of around £215 paid over three years.

Perhaps more shocking is the premium paid on service cover. Two additional years service cover (on top of the statutory one year guarantee) costs £382 through the rent-to-own scheme. Three additional years taken from a high street retailer costs around a third of the price, at £130. There appears to be no clear rationale for this premium paid by low income families on service cover.

The total cost through rent-to-own credit comes in at over £1,250 compared to £470 when bought from a high street retailer. "

Part of the rip-off in the above example involves two additional years service cover costing £382 on top of the statutory one year guarantee. The rent-to-buy company enforcing this claim that as the item is only being 'rented' they need to know it is being properly maintained. However their price is nearly three times higher than the cost of £130 for the same cover bought in the high street. Nasty and brutish.

Putting aside the brutish scam on the extended guarantee, the more elegant though equally nasty mathematical part of the scheme works like this:

You want a fridge-freezer, and decide on this one.

You want a fridge-freezer, and decide on this one.This fridge was available in Sainsbury's for a cash price of £575.

The "rent to own" company would charge you £1,043.64 to pay for this over 156 weeks (3 years).

Their stated interest rate is 29.9% - which as an interest rate sounds within the bounds of reasonableness.

However, the rip-off is they keep the interest rate low by putting the 'cash price' up to £724.97.

By putting up the 'cash price', the effect is to make the 'cost of credit' lower.

By making the 'cash price' £150 more than Sainsbury's, the cost of credit is magically reduced by £150.

Rent to Buy price is £1,043.64.

If this was based on the Sainsbury's price of £575, then the cost of credit is £468.64 (£1,043.64 - £575 = £468.64)

By putting the "basic price" up to £724.97, the cost of credit has "dropped" to £318.67 (£1,043.64 - £724.97 = £318.67)

The result, the 'rent to buy' company can claim to be charging 29.9% interest. When the true interest, based on the far better Sainsbury's price, would be more like 54%.

At its most cynical extreme, a vendor could set the "basic price" to £1,043.64, and then advertise the fridge, quite mathematically truthfully, at Zero Percent! What a

And that's one way to hide an excessive interest rate.

Saturday, 21 January 2012

Saturday, January 21, 2012

Posted by Jake

2 comments

Labels: energy, Liebrary, OFGEM, politicians, regulation

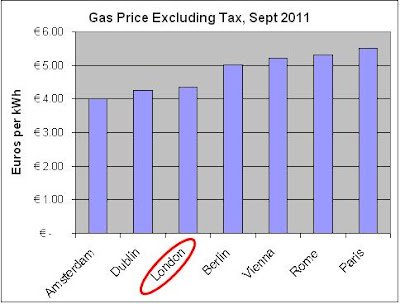

One of the true things energy companies say, (and never forget, the most effective rip-offs are done without lying) is that the UK has low domestic gas and electricity prices compared with most of the European Union. This statement has often been used by energy industry apologists to squirm out of a tight interview.

One of the true things energy companies say, (and never forget, the most effective rip-offs are done without lying) is that the UK has low domestic gas and electricity prices compared with most of the European Union. This statement has often been used by energy industry apologists to squirm out of a tight interview. The interviewer almost never knows the hidden truth behind the truthful facade.

What the apologists are rather shy about is the fact that the price difference is due to UK taxes on retail energy being about the lowest in the EU. If you strip out the government taxes - money which doesn't go into the pockets of the energy companies - UK energy prices are about the same as the rest of the EU.

What the apologists are rather shy about is the fact that the price difference is due to UK taxes on retail energy being about the lowest in the EU. If you strip out the government taxes - money which doesn't go into the pockets of the energy companies - UK energy prices are about the same as the rest of the EU.Figures from the Household Energy Price Index for Europe (HEPI), show that the cash pocketed by the British energy companies is about the same as in the rest of the EU, in spite of them using the "UK's lowest prices" argument for their price hikes.

So that's ok, isn't it? We pay about the same as our European cousins?

Actually, it isn't.

According to the International Energy Agency figures for 2010, Britain is 60.9% self-sufficient in Natural Gas, which is the source of gas (naturally) and electricity generation in the UK.

Contrast that with the other European Union nations who have to import anything between 80% and 98% of their gas.

British energy companies claim to run on wafer-thin margins by moving their profits from downstream (selling to customers) to upstream (sucking the stuff out of the good Earth).

Of course, the energy industry has a whole quiver of fibs, including:

- Retail prices go up with wholesale prices, but fail to come down with them.

- The accounting trick that allows them to fib about low profit margins.

- Confusing pricing that, according to the head of OFGEM in evidence to Parliament, has meant "40% of consumers who have switched [supplier] have switched to a weaker deal"

- Doorstep selling tactics described by the parliamentary energy select committee as "Del Boy sales tricks", tricking customers into worse contracts by contacting them individually at home.

While other countries who are dependent on imports can plead that global wholesale price force them to put their retail prices up, the British energy companies have no such excuse.

International wholesale energy prices (which for the European gas market is in any case rigged to follow oil despite the extremely tenuous supply/demand connection between oil and gas) is a cover for them doing something not because they have to, but because they can.

International Energy Association figures for Natural Gas.

International wholesale energy prices (which for the European gas market is in any case rigged to follow oil despite the extremely tenuous supply/demand connection between oil and gas) is a cover for them doing something not because they have to, but because they can.

International Energy Association figures for Natural Gas.

"Each year in England and Wales, many thousands of people aged 65 and over die needlessly in the winter months. This is often because older people can't afford to heat our homes and they are more susceptible to illnesses caused by cold and damp. Age UK is campaigning to reduce the number of excess winter deaths.

The latest figures show that last winter (2010-11) there were almost 22,000 additional deaths among people over the age of 65 in England and Wales.

The cost to society is enormous. For every additional winter death, there are also around 8 admissions to hospital, 32 visits to outpatient care and 30 social services calls."

The Big Six choosing to impose high prices on consumers is simple profiteering, with the profits paid for by everybody.

The Big Six choosing to impose high prices on consumers is simple profiteering, with the profits paid for by everybody. The poor and vulnerable sometimes pay with their lives.

Friday, 20 January 2012

Friday, January 20, 2012

Posted by Jake

No comments

Labels: banks, credit crunch, inequality, protests, the courts

Tuesday, 17 January 2012

Tuesday, January 17, 2012

Posted by Jake

No comments

Labels: budget cuts, credit crunch, education, Gove, inequality, politicians, the government

Chris, Fee and KJ weigh up Michael Gove's suggestion for a £60m royal yacht against his education cuts

Sunday, 15 January 2012

Sunday, January 15, 2012

Posted by Jake

10 comments

Labels: Article, benefits, budget cuts, elections, expense fraud, HMRC, inequality, MP, pay, pensions, politicians, public sector, taxation, the government

The British Army has a brave tradition known as the "Forlorn Hope": a band of soldiers who would make the first assault against a well defended position. None of the Forlorn Hope was expected to survive unscathed; few were expected to survive at all. In spite of the extreme danger there was rarely a shortage of volunteers. Ambitious men who had a forlorn hope of being plucked from obscurity, veterans who hoped forlornly to show they still had what it takes, or those on their last legs forlorn and yet hopeful of leaving the mark they had failed to leave in their careers so far. Survivors were rewarded with promotion, glory, and cash.

The British Army has a brave tradition known as the "Forlorn Hope": a band of soldiers who would make the first assault against a well defended position. None of the Forlorn Hope was expected to survive unscathed; few were expected to survive at all. In spite of the extreme danger there was rarely a shortage of volunteers. Ambitious men who had a forlorn hope of being plucked from obscurity, veterans who hoped forlornly to show they still had what it takes, or those on their last legs forlorn and yet hopeful of leaving the mark they had failed to leave in their careers so far. Survivors were rewarded with promotion, glory, and cash.British Members of Parliament have set up their own Forlorn Hope, in the form of the Committee on Members' Expenses. Their objective is to scale the heights of public outrage and outflank the entrenched disgust of voters at our MPs' pilfering, and breach the defences of the public purse. If their assault is successful they will earn the whispered gratitude of the whole House of Commons, perhaps with ministries for the survivors and peerages for the fallen.

As Britain was distracted by thoughts of Christmas food, presents, and relatives, our intrepid MPs quietly made their opening gambit. Objective, to sneak through a remuneration rise in the face of the current freeze on public sector pay. The committee, set up in July 2011, published its first report early in December 2011. One of its key recommendations (Recommendation 17):

- IPSA provide a detailed explanation of the rationale for its existing London supplements (especially the Outer London one) and make transparent its current methodology for calculation of the rates.

- A body independent of both Parliament and IPSA be commissioned by the House Service to undertake a financial cost-benefit analysis to determine whether extending IPSA's current system of London and Outer London supplements to other regions in the UK could provide greater value for money for taxpayers..

- In not more than six months' time, the House should have the opportunity to consider the merits of that cost-benefit analysis and evaluation and to make a decision on whether there should or should not be a system of regional supplements instead of the existing travel and accommodation provisions.

(IPSA=Independent Parliamentary Standards Authority)

The committee, you will note, has identified “a system of regional supplements” as a means of capturing a few extra £000s using the Outer London allowance as its Trojan Horse. So, what is this all about? Referred to as the London Area Living Payment, the details are:

Eligibility: MPs for constituencies in Greater London, plus 24 MPs who are outside Greater London but are in the “London Area” (within 20 miles of Parliament).

Value: £3,760 per annum for MPs in Greater London

£5,090 per annum for the 24 MPs in the “London Area”

In order to reinforce the argument for inflating these relatively modest amounts, the committee asks IPSA to ‘make transparent’ its methodology for calculation of the London supplements. IPSA publishes an FAQ document, with the following statement on how it calculates the additional £1,330 per annum for the outer London MPs:

“IPSA took the average cost of a return, at peak time, from a major rail terminus in each of the 24 constituencies entitled to the additional amount, and multiplied this by four days a week, for 30 weeks a year. Allowing for tax (which is paid by MPs on the LALP at a rate of 40%), this equated to an average additional cost per MP of £1,330 per year.”

From this we see that IPSA assumes that our hard working MPs spend 120 days a year in Parliament. Or perhaps 150, as this calculation equates to the price of an annual season ticket.

The existing travel and accommodation provisions allow MPs to claim £150 per night for hotel accommodation in London, or £19,900 a year for renting an apartment.

The expense allowance for travel has no upper limit. The “MPs’ Expenses Scheme” document specifies what travel is covered:

MPs may claim for Travel and Subsistence Expenditure for journeys which are necessary for the performance of their parliamentary functions, and fall into one of the following categories:

a. for MPs who are eligible for Accommodation Expenditure, journeys between any point in the constituency (or a home or office within 20 miles of their constituency boundary) and Westminster or a London Area home;

b. for MPs who are not eligible for Accommodation Expenditure, journeys between their constituency office and Westminster;

c. travel within the constituency or within 20 miles of the constituency boundary;

Using IPSA’s assumption of our MPs spending 30 weeks a year in Westminster, our non-London representatives would be able to claim for 30 return tickets from their constituencies. Without limit! Which perhaps puts a new perspective on parliament’s pusillanimous performance on runaway rail fares, with season tickets up to 10 times more per mile than in Europe.

MPs are entitled to an “Anytime standard class rail travel return”, which at UK ticket prices adds up to a pretty penny. In fact, checking some example fares, tens of thousands of pretty pennies:

Using IPSA’s assumption for London MPs, that they come in to Westminster to work for 30 weeks a year, it is no wonder the rest of our MPs are drooling just a little bit. Rather than have to submit expense claims for what they actually spend, the prospect of getting a top-up of over £20,000 (travel + accommodation) a year would make most people salivate.

And it almost makes sense! Wouldn’t it save the cost and effort of filling in all those forms, and paying a bean-counter to check and hand out all the little payments? Except for the fact that being an MP is one of the very few public sector professions where

a) you don’t have to turn up at work

AND

AND

b) you can hold down as many other paid jobs as you like

Under these circumstances, actually having to incur an expense before being able to get it reimbursed is highly inconvenient. Much better to get it paid as an additional allowance, without any further scrutiny.

As we can see from the Members’ Register of Interests, here are a few random examples taken from the full declarations of our MPs who find time to earn an extra crust or two away from their political vocation, doing their hobbies:

· £3,333 per month as deputy chairman of an energy exploration company.

· £175,000 for work as a practicing barrister between December 2010 and July 2011

· £102,568.22 for role of Distinguished Global Leader in Residence at a US university.

· £62,181.32 for a speech in Nigeria.

· £40,000 for work paid for by a school between September 2010 and November 2011

· £20,000 for advising a recruitment company between February 2011 and November 2011

· £1,234.06 per month from June-December 2010, rising to £2,083 per month from January 2011 as a director of a software services company.

· £11,759 per quarter as a director of an energy exploration company.

· £75,000 per year as vice chairman of a northern football club

· Something between £90,000-£95,000 per annum as an adviser to a venture capital company.

· £15,300 for giving a speech at an insurance industry event in Claridge’s Hotel, London.

· Et cetera, et pecunia…..

Are expenses really so complicated and costly to administer? British organisations, commercial and public sector, have managed for hundreds of years. In the new-fangled internet era, MPs need look no further than Her Majesty’s Revenue and Customs, who helpfully provide a complete A to Z considered adequate for the use of us ordinary ripped-off Britons.

Thursday, 12 January 2012

Thursday, January 12, 2012

Posted by Jake

No comments

Labels: benefits, budget cuts, inequality, jobs, politicians, protests

Monday, 9 January 2012

Monday, January 09, 2012

Posted by Jake

No comments

Labels: Bonus, Cameron, executive, politicians, regulation, Tories

Sunday, 8 January 2012

By Stefan Stern, visiting professor of management practice at the Cass Business School.

At the end of 2011 they interred the ashes of the man who urged us to "live in truth".

Vaclav Havel's funeral was, perhaps unexpectedly, quite uplifting, a reminder that speaking the truth with courage and conviction can still be the most powerful weapon of all. It can bring down governments and change the course of history. In the Arab world this year, the word from the streets has helped to overturn seemingly unshakeable dictatorships.

The less uplifting thought is that, elsewhere in the world, truth has been a casualty, caught in the crossfire of lies, self-deception and legalese that broke out repeatedly in 2011. Economic and political crises, such as the one we are living through, are sometimes called "moments of truth". Will the new year bring us a fresh outpouring of truth-telling and a healthy purge of the deceivers? Or will mendacity win out, again?

The less uplifting thought is that, elsewhere in the world, truth has been a casualty, caught in the crossfire of lies, self-deception and legalese that broke out repeatedly in 2011. Economic and political crises, such as the one we are living through, are sometimes called "moments of truth". Will the new year bring us a fresh outpouring of truth-telling and a healthy purge of the deceivers? Or will mendacity win out, again?

The Truth – an ambiguous and elusive concept, I know – has actually been in trouble for some time. In 1997, Peter Mandelson told the journalist Katharine Viner: "If you're accusing me of getting the truth across... that I'm trying to create the truth – if that's news management, I plead guilty." The recent Bush administration had a more troubling and grandiose view. An unnamed aide told Ron Suskind in 2004 that those who worked in what the source called "the reality-based community" did not understand "the way the world really works any more... We're an empire now, and when we act, we create our own reality... We're history's actors... and you, all of you, will be left to just study what we do".

This is not the cue for another discussion on the whereabouts of (non-existent) weapons of mass destruction. But three decades after Vaclav Havel had told us to live in truth, the film-maker Michael Moore declared that "we live in fictitious times" (speaking at the Oscars ceremony in 2003), while the satirist Stephen Colbert coined the term "truthiness" to describe those things that we feel and know ought to be true, but sadly just cannot (and never will) prove. Anyhow, who needs mere facts when ambition and faith are leading you on? "I only know what I believe," as Tony Blair told the Labour party conference in 2004.

In the new year, we will have a US presidential election, quite possibly to be fought between those two fine Harvard men, Barack Obama and Mitt Romney. Harvard University's motto is "Veritas". Will this campaign be a great moment of Truth? Maybe not. In fact, the economist Paul Krugman has already labelled former Governor Romney's efforts "post-truth politics". Last week, Romney stated: "President Obama believes that government should create equal outcomes. In an entitlement society, everyone receives the same or similar rewards, regardless of education, effort, and willingness to take risk." The wild inaccuracy of this assertion is hard to reconcile with the candidate's Mormon faith.

Back home, there may be a useful outcome to the ongoing Leveson Inquiry into the "culture, practice and ethics of the press". So far, proceedings have resembled a kind of truth and reconciliation committee, although probably with a bit more of the former than the latter. Together with the hearings of the Culture, Media and Sport Select Committee, this process has given us a crash course in legalistic jargon and evasiveness. The phrases "I have no recollection", "I do not recall" or "To the best of my knowledge..." have rung out again and again this year. And every time they have, another truth fairy has died.

The high/low point was probably the evidence given by the former Daily Mirror editor Piers Morgan, who was keen to support the apparently widely held view that senior executives could not really be expected to know what was going on in their organisations. Unfortunately for Morgan, he had already written about dubious and illegal newspaper practices in his memoirs. This put him in the uncomfortable position of having to cast doubt on his own book – almost accusing himself of being a liar. It had come to this.

The truth is we should not be too naive or idealistic. Nobody tells the whole truth all of the time. It would make life impossible. Families have secrets and unmentionables, as many will have been reminded this Christmas. When a husband is asked by his wife whether a certain outfit flatters her figure, or not, there really is only one sensible answer to give, regardless of the actualité. At work, we cannot always tell people we can't stand them, even if it is true. It is probably wise not to disagree with the boss too often, even if he or she is wrong and/or an idiot. And few saints or unflinching truth-tellers get to the top.

But there is a bigger, more worrying problem in this post-fact world where powerful people are relaxed about lying, or "creating their own reality" if you prefer. Never mind mere (moral) relativism: cynical detachment from truth is destructive and destabilising. The challenges that face us are so great that we really have to "confront the brutal facts", as the management guru Jim Collins puts it. The continuing nonsense of the eurozone is an example of what happens when a generation of political and financial leaders refuses to acknowledge the scale of the problems. When the Italian welfare and labour minister Elsa Fornero broke down while announcing necessary changes to pensions, that too was a belated moment of truth.

We need to start having "truthful conversations", says Dov Seidman, CEO of the ethics consultancy LRN. We will have to fix our problems ourselves, through our own actions. And our behaviour has to be rooted in a shared (and accurate) sense of reality.

"All I want is the truth," sang John Lennon in 1971. "Just gimme some truth!" In 2012, we will be confronted by some unpleasant truths about our economy and our place in the world. Will we be able to handle it? And will anyone be competent and courageous enough to lead us through it?

The writer is visiting professor of management practice at the Cass Business School, London. He was a columnist for the FT, and now writes occasionally for the Guardian and the Independent.

This article was first published in the Independent

This article was first published in the Independent

By Stefan Stern, visiting professor of management practice at the Cass Business School.

At the end of last year they interred the ashes of the man who urged us to "live in truth".

Vaclav Havel's funeral was, perhaps unexpectedly, quite uplifting, a reminder that speaking the truth with courage and conviction can still be the most powerful weapon of all. It can bring down governments and change the course of history. In the Arab world this year, the word from the streets has helped to overturn seemingly unshakeable dictatorships.

The less uplifting thought is that, elsewhere in the world, truth has been a casualty, caught in the crossfire of lies, self-deception and legalese that broke out repeatedly in 2011. Economic and political crises, such as the one we are living through, are sometimes called "moments of truth". Will the new year bring us a fresh outpouring of truth-telling and a healthy purge of the deceivers? Or will mendacity win out, again?

The less uplifting thought is that, elsewhere in the world, truth has been a casualty, caught in the crossfire of lies, self-deception and legalese that broke out repeatedly in 2011. Economic and political crises, such as the one we are living through, are sometimes called "moments of truth". Will the new year bring us a fresh outpouring of truth-telling and a healthy purge of the deceivers? Or will mendacity win out, again?

The Truth – an ambiguous and elusive concept, I know – has actually been in trouble for some time. In 1997, Peter Mandelson told the journalist Katharine Viner: "If you're accusing me of getting the truth across... that I'm trying to create the truth – if that's news management, I plead guilty." The recent Bush administration had a more troubling and grandiose view. An unnamed aide told Ron Suskind in 2004 that those who worked in what the source called "the reality-based community" did not understand "the way the world really works any more... We're an empire now, and when we act, we create our own reality... We're history's actors... and you, all of you, will be left to just study what we do".

This is not the cue for another discussion on the whereabouts of (non-existent) weapons of mass destruction. But three decades after Vaclav Havel had told us to live in truth, the film-maker Michael Moore declared that "we live in fictitious times" (speaking at the Oscars ceremony in 2003), while the satirist Stephen Colbert coined the term "truthiness" to describe those things that we feel and know ought to be true, but sadly just cannot (and never will) prove. Anyhow, who needs mere facts when ambition and faith are leading you on? "I only know what I believe," as Tony Blair told the Labour party conference in 2004.

In the new year, we will have a US presidential election, quite possibly to be fought between those two fine Harvard men, Barack Obama and Mitt Romney. Harvard University's motto is "Veritas". Will this campaign be a great moment of Truth? Maybe not. In fact, the economist Paul Krugman has already labelled former Governor Romney's efforts "post-truth politics". Last week, Romney stated: "President Obama believes that government should create equal outcomes. In an entitlement society, everyone receives the same or similar rewards, regardless of education, effort, and willingness to take risk." The wild inaccuracy of this assertion is hard to reconcile with the candidate's Mormon faith.

Back home, there may be a useful outcome to the ongoing Leveson Inquiry into the "culture, practice and ethics of the press". So far, proceedings have resembled a kind of truth and reconciliation committee, although probably with a bit more of the former than the latter. Together with the hearings of the Culture, Media and Sport Select Committee, this process has given us a crash course in legalistic jargon and evasiveness. The phrases "I have no recollection", "I do not recall" or "To the best of my knowledge..." have rung out again and again this year. And every time they have, another truth fairy has died.

The high/low point was probably the evidence given by the former Daily Mirror editor Piers Morgan, who was keen to support the apparently widely held view that senior executives could not really be expected to know what was going on in their organisations. Unfortunately for Morgan, he had already written about dubious and illegal newspaper practices in his memoirs. This put him in the uncomfortable position of having to cast doubt on his own book – almost accusing himself of being a liar. It had come to this.

The truth is we should not be too naive or idealistic. Nobody tells the whole truth all of the time. It would make life impossible. Families have secrets and unmentionables, as many will have been reminded this Christmas. When a husband is asked by his wife whether a certain outfit flatters her figure, or not, there really is only one sensible answer to give, regardless of the actualité. At work, we cannot always tell people we can't stand them, even if it is true. It is probably wise not to disagree with the boss too often, even if he or she is wrong and/or an idiot. And few saints or unflinching truth-tellers get to the top.

But there is a bigger, more worrying problem in this post-fact world where powerful people are relaxed about lying, or "creating their own reality" if you prefer. Never mind mere (moral) relativism: cynical detachment from truth is destructive and destabilising. The challenges that face us are so great that we really have to "confront the brutal facts", as the management guru Jim Collins puts it. The continuing nonsense of the eurozone is an example of what happens when a generation of political and financial leaders refuses to acknowledge the scale of the problems. When the Italian welfare and labour minister Elsa Fornero broke down while announcing necessary changes to pensions, that too was a belated moment of truth.

We need to start having "truthful conversations", says Dov Seidman, CEO of the ethics consultancy LRN. We will have to fix our problems ourselves, through our own actions. And our behaviour has to be rooted in a shared (and accurate) sense of reality.

"All I want is the truth," sang John Lennon in 1971. "Just gimme some truth!" In 2012, we will be confronted by some unpleasant truths about our economy and our place in the world. Will we be able to handle it? And will anyone be competent and courageous enough to lead us through it?

The writer is visiting professor of management practice at the Cass Business School, London. He was a columnist for the FT, and now writes occasionally for the Guardian and the Independent.

This article was first published in the Independent

This article was first published in the Independent

Wednesday, 4 January 2012

By Sophie Allain, campaigner at Campaign for Better Transport.

In the first week of 2012 thousands of rail passengers fed up with being ripped off by above inflation rail fare rises took part in a social media protest, showing that fares continue to be a highly charged political issue. It’s not surprising that British passengers are angry, Campaign for Better Transport compared a sample UK season ticket with four similar European ones and discovered we’re paying up to ten times as much as our European counterparts.

“We knew we had some of the most expensive rail fares in Europe, if not the world, but even we were shocked by how much more the UK ticket was in comparison to our European counterparts.

"When the cost of season tickets is so much higher than other European capitals, the Government’s fare rises are starting to affect the UK’s competitiveness. That’s why if the Government is serious about promoting economic growth it must also look at reducing planned fare rises in 2013 and 2014 as part of a policy to cut fares and make public transport truly affordable.”

In the first week of 2012 thousands of rail passengers fed up with being ripped off by above inflation rail fare rises took part in a social media protest, showing that fares continue to be a highly charged political issue. It’s not surprising that British passengers are angry, Campaign for Better Transport compared a sample UK season ticket with four similar European ones and discovered we’re paying up to ten times as much as our European counterparts.

Campaign for Better Transport compared the cost of an annual season ticket into five major European capitals. Despite the Government’s concession in the Autumn Spending review to cap regulated fare increases to inflation plus one per cent in January, instead of inflation plus three per cent as originally planned, the transport charity discovered the sample UK ticket cost three and a half times more than the most expensive European one, and almost ten times (9.7) more than the cheapest one.

The cost of an annual season ticket, including multi-modal travel on each city's underground system, from a commuter town approximately 23 miles from the capital:

Woking to London, £3,268

Ballancourt-sur-Essonne to Paris, £924.66

Strausberg to Berlin, £705.85

Collado-Villalba to Madrid, £653.74

Velletri to Rome, £336.17

Sophie Allain, Campaign for Better Transport’s public transport campaigner, said:The cost of an annual season ticket, including multi-modal travel on each city's underground system, from a commuter town approximately 23 miles from the capital:

Woking to London, £3,268

Ballancourt-sur-Essonne to Paris, £924.66

Strausberg to Berlin, £705.85

Collado-Villalba to Madrid, £653.74

Velletri to Rome, £336.17

“We knew we had some of the most expensive rail fares in Europe, if not the world, but even we were shocked by how much more the UK ticket was in comparison to our European counterparts.

"When the cost of season tickets is so much higher than other European capitals, the Government’s fare rises are starting to affect the UK’s competitiveness. That’s why if the Government is serious about promoting economic growth it must also look at reducing planned fare rises in 2013 and 2014 as part of a policy to cut fares and make public transport truly affordable.”

We discovered an annual ticket from a commuter town outside Berlin, Madrid, Paris and Rome cost a fraction of the price of an equivalent ticket to London. Italian commuters pay a tenth of the UK price, while the French have the second most expensive fares and yet still only pay less than a third that passengers in the UK pay. If this was not bad enough, UK rail fares rose above inflation again this week, and Government policy means even steeper rises in 2013 and 2014. By 2015 our fares will be 24 per cent higher than 2011 prices.

We hear from people, week in week out, who are affected by the fare rises; working parents who can’t afford the cost of childcare as well as their season ticket, people having to move closer to their job, families who pay more on train tickets than they do on their mortgage. It paints a very worrying picture.

Complaining about the rail service is already a staple British topic of conversation, but the political weight of irate rail passengers should not be underestimated. Last year, a YouGov poll we commissioned found that 74 per cent of regular rail users in London and the South-East could switch their support away from a political party that introduced an increase in the cap on rail fares.

Many people simply have no choice but to get on the train to work. Driving into London, or to any of our major cities at rush hour, only further clogs up our congested roads, making journeys even longer and adding to pollution. Regulation was brought in to protect rail passengers, but now Government policy is using regulation to bring in revenue for the Treasury. Passengers are already contributing a growing percentage of rail income and investment funding, but the lack of transparency around the issue means we can be far from sure what will happen to these additional funds. Fare rises have become in effect a stealth tax on those people who do the right thing and use public transport.

Sophie Allain is the public transport campaigner at Campaign for Better Transport and runs the Fair Fares Now campaign (www.fairfaresnow.org.uk)

Notes to Editors

1. Woking to London (22 miles)

An annual season ticket from Woking to London zones 1-6 is £3,268 (€3928,14)http://www.nationalrail.co.uk/

Ballancourt-sur-Essonne to Paris (24 miles)

Ballancourt is served by the RER (Regional Express Network) and lies in zone 5of the D4 branch line. An annual ticket for unlimited travel within zones 1-5 is £924.66 (€1112,50)

http://www.ratp.fr/fr/ratp/c_21131/forfait-navigo-annuel/

An annual season ticket from Woking to London zones 1-6 is £3,268 (€3928,14)http://www.nationalrail.co.uk/

Ballancourt-sur-Essonne to Paris (24 miles)

Ballancourt is served by the RER (Regional Express Network) and lies in zone 5of the D4 branch line. An annual ticket for unlimited travel within zones 1-5 is £924.66 (€1112,50)

http://www.ratp.fr/fr/ratp/c_21131/forfait-navigo-annuel/

Strausberg to Berlin (21 miles)

Strausberg is on the S5 line of the Berlin S-Bahn in zone C. An annual ticket includes travel within zones A,B and C and is £705.85 (€848) http://www.s-bahn-berlin.de/aboundtickets/zeitkarten.htm

Strausberg is on the S5 line of the Berlin S-Bahn in zone C. An annual ticket includes travel within zones A,B and C and is £705.85 (€848) http://www.s-bahn-berlin.de/aboundtickets/zeitkarten.htm

Collado-Villalba to Madrid (22 miles)

Ceranias is the commuter network and Villalba is the last stop on the C-10 line in zone B3. A multi modal annual pass for zone B3 is £653.74 (€785,40)

http://www.renfe.com/viajeros/cercanias/madrid/abonos_y_descuentos/abono_transporte.html

Velletri to Rome (22 miles)

Velletri is in Zone C on the suburban train network line FR4. An annual pass for unlimited travel in three zones (A-C) is £336.17 (€404) cash or £357.73 (€430,20) in installmentshttp://www.cotralspa.it/ENG/biglietti_abbonamenti_4.asp

Ceranias is the commuter network and Villalba is the last stop on the C-10 line in zone B3. A multi modal annual pass for zone B3 is £653.74 (€785,40)

http://www.renfe.com/viajeros/cercanias/madrid/abonos_y_descuentos/abono_transporte.html

Velletri to Rome (22 miles)

Velletri is in Zone C on the suburban train network line FR4. An annual pass for unlimited travel in three zones (A-C) is £336.17 (€404) cash or £357.73 (€430,20) in installmentshttp://www.cotralspa.it/ENG/biglietti_abbonamenti_4.asp

All ticket prices are for current tickets at time of publication. Exchange rate correct at time of publication. Distances calculated using http://distancecalculator.globefeed.com

3. Campaign for Better Transport launched the Fair Fares Now campaign in January to call for cheaper, simpler, fairer rail ticketing. Visit the website for more informationwww.fairfaresnow.org.uk

4. Campaign for Better Transport is the UK's leading authority on sustainable transport. We champion transport solutions that improve people's lives and reduce environmental damage. Our campaigns push innovative, practical policies at local and national levels. Campaign for Better Transport Charitable Trust is a registered charity (1101929).

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

Priority

property

protests

public sector

Puppets

Ready

regulation

retailers

Roundup

sales techniques

series

SFO

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

UK Uncut

unions

Vince

water

Archive

-

▼

2012

(213)

-

▼

January

(17)

- Income inequality and grossly overpaid CEOs

- Good capitalism is good business - some tips on ho...

- Exercising consumer rights

- Tax credits... for the super-rich

- Liebrary: How companies hide excessive interest ra...

- Liebrary: Are Britain's energy companies' charges ...

- Occupy movement evicted

- Education cuts will scuttle literacy levels

- MPs make a try for a discrete £20k+ pay-rise in th...

- Atos: not fit to work the 'fit to work' test

- Fat cat pay rewards failure

- Nobody tells the whole truth. But is a bit more of...

- Nobody tells the whole truth. But is a bit more of...

- UK rail commuters pay three and a half times more ...

- Idiotic train & bus fare hikes consume 20% of low ...

- Liebrary: The real reason why British rail fares a...

- Our message to Ripped-Off Britons: be resolute! Ri...

-

▼

January

(17)

Powered by Blogger.