[If you want to read Part 1 click here, but you don't need to]

It was a former leading Labour politician, Peter Mandelson, who said “we are intensely relaxed about people getting filthy rich”. A philosophy that has been followed doggedly by Labour and Conservatives alike for over 30 years. Ministerial claims of shock at tax avoidance and horror at excessive pay have been nothing but camouflage for this policy.

It was a former leading Labour politician, Peter Mandelson, who said “we are intensely relaxed about people getting filthy rich”. A philosophy that has been followed doggedly by Labour and Conservatives alike for over 30 years. Ministerial claims of shock at tax avoidance and horror at excessive pay have been nothing but camouflage for this policy. Particularly since the cut in the top rate tax from 50% to 45%, in the March 2012 budget, government ministers have been swearing that cutting income tax for the rich makes us all richer. They claim lower tax encourages clever entrepreneurs to come and work hard and give us all jobs, and bring us economic growth. The opposition swears that this is not true.

Each side says it with such earnest confidence that we ordinary Britons don't know what to think. So we just let the politicians carry on as usual, which the politicians do with great and insatiable appetite.

But the truth is out there, if you know where to look.

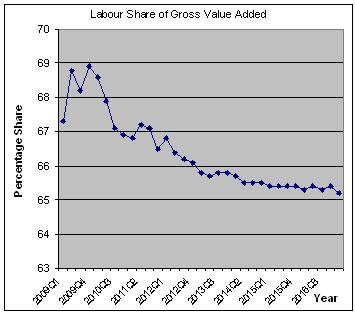

The impact of this philosophy is made very clear by the graphs below from a paper by the Centre for Economic Policy Research. Graphs that expose a great and stubborn lie: that allowing people to get 'filthy rich' is good for national economic growth. The lie that if the few get ‘filthy rich’ we will all get mussed up with a splattering of extra wealth ourselves. The fib used to justify slashing personal and corporation tax. It is asserted that so long as there is a feast at the top table we all will get some of the leftovers. The evidence below shows that this assertion is false.

This first graph below shows there is actually no correlation between economic growth and cutting taxes - massive tax cuts for the rich make no difference to growth. The horizontal band of countries, excluding Ireland, shows that countries like the UK and the US who cut taxes most aggressively saw no greater economic growth than Germany, Australia, and many others who made smaller or no top rate tax cuts. Here is yet more evidence against the lie that letting the 1% get rich makes us all richer - evidence that is all around us. That successive governments stubbornly stick to it supports the theory of Goebbels, the nazi propagandist, “If you tell a lie big enough and keep repeating it, people will eventually come to believe it.”

On the other hand, the next graph shows there is a clear correlation between reducing tax and increasing inequality. As their taxes were slashed, the top 1% accrued even greater wealth because

a) Less was taken away from them in taxes, leaving them more to pocket.

b) As they were allowed to keep more they were more incentivised to grab a bigger slice of the pie. Not by creating a bigger pie and spreading the wealth, but by snatching a bigger share with excessive pay and excessive profits.

Providing low tax rates and plentiful routes for tax avoidance – which the chancellor George Osborne found so shocking in spite of his complicity – do nothing more than enrich the few with no benefit to the many.

The extraordinary degree to which taxation policy swung in favour of the top 1% is shown in these two graphs. Between 1975-79 and 2004-2008 the UK and US swung the scales in favour of the wealthiest. While Germany, the economic powerhouse of Europe, demonstrated steady growth and steady income shares by maintaining a 60% top marginal tax rate.

The key characteristics that make successful leaders are impossible to define.

Combinations of character traits create different outcomes. An excessive affection for drink has ruined many men, and yet that famous toper Sir Winston Churchill was a great leader. Like mixing colours the presence of a particular trait manifests itself in strange ways.

But of the essential ingredients found in leaders two stand out:

- A clear objective

- A conviction that the ends justify the means

Of course, to paraphrase Lord Palmerstone, leaders have no permanent objectives only permanent interests (which generally centre around themselves). However, the conviction that the ends justify the means is strong in almost all successful leaders.

It is this conviction that enables leaders to abuse the truth far more frequently, comprehensively, effectively, malignly, and shamelessly than the rest of us admittedly fallible and flawed humans. From tobacco bosses' claims that smoking does not cause cancer, to energy company executives claiming price changes are driven by wholesale energy costs, to bankers promising to provide high investment returns, cheap loans and a prosperous retirement. And to cabinet ministers claiming to be surprised by tax avoidance, misremembering whether or not they authorised aiding and abetting kidnapping and rendition, or experiencing memory lapses whether they authorised a special adviser or best mate to duck and dive on their behalf.

Look back at the news archives, and you will find these leaders looking the camera straight in the lens with their most earnestly open and honest expressions, only to be exposed as fibbers and liars a few months or years later. In truth, they don't care. They have salted away their rewards, and care nothing for their subsequent exposure.

They know many of us know they are lying. They don't care if we know they know we know they are lying. Their satisfaction is we never do anything about it.

Stopping lies being told is an impossible and futile task. The best we can do is spread evidence to expose them. Sometimes with a tweet and a link. Sometimes with a conversation. Always with evidence.

Look back at the news archives, and you will find these leaders looking the camera straight in the lens with their most earnestly open and honest expressions, only to be exposed as fibbers and liars a few months or years later. In truth, they don't care. They have salted away their rewards, and care nothing for their subsequent exposure.

They know many of us know they are lying. They don't care if we know they know we know they are lying. Their satisfaction is we never do anything about it.

Stopping lies being told is an impossible and futile task. The best we can do is spread evidence to expose them. Sometimes with a tweet and a link. Sometimes with a conversation. Always with evidence.