TOP STORIES

-

LATEST: Think you’re paying less tax now? The withdrawal of Working and Child Tax Credits leaves low earners paying a 73% marginal tax rate, and medium earners paying even more

...And this government says it cuts taxes for poor working households!

-

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST WEEK'S MEDIA

Drug firm Novartis tried to 'scupper' trials of a cheaper version of eye medicine

Has Austerity caused the UK’s first decline in life expectancy in 20 years?

Kellogg's effectively paid no corporation tax in the UK in 2013, +more stories...

-

YOU'RE FIRED?! We are already nearly the most easily fired people in the developed world

Only the US and Canada make it easier, says the OECD’s Worker Protection Index -

EYE OPENER: Housing Equity Withdrawal took off in 1979. Since then almost all UK growth has suspiciously equalled the amount we took out. Looks like it’s pensions next

Osborne’s new rules allow you to spend your entire pension pot now. Same mistake, different pot -

DID YOU KNOW? MPs are getting a 10% pay hike in May, to £74k

...and in 2010, 137 MPs put family members on parliament's payroll. Now it's soared to 167

CARTOONS

Friday, 29 April 2011

Wednesday, 27 April 2011

Sunday, 24 April 2011

Sunday, April 24, 2011

Posted by Jake

2 comments

Labels: Article, banks, British Bankers Assoc, FSA, insurance

The banks have been comprehensively routed in the courts, and been publicly exposed in the most blatant stinking mis-selling of overpriced insurance to people who didn’t want it, didn’t understand it, and to people who weren’t even eligible to claim on it. So why are the banks going to draw out their humiliation with an appeal over Payment Protection Insurance (PPI)? The reason has little to do with PPI itself, and everything to do with something much more fundamental to the industry. The banks need to protect their right to do the wrong thing.

Regulation in the UK has been like a television game-show. The competitors – the banks, investment companies, insurers and the like – get to keep everything they can grab until the clock runs out. Gutless regulation and enforcement in the UK spends years investigating a rip-off, and then requires rippers-off to stop the ripping and pay fines and compensation that are a fraction of the ill-gotten gains. Leaving them to pocket the balance. A fact that is clear from the paltry fines imposed by the FSA.

This allows the rippers-off years of making profit, and then moving on to their next rip-off. Already a new variety of insurance “Accident, Sickness and Unemployment”, which seems to be closely related to PPI, is being marketed.

It is the “game-show regulation” that the British bankers want to salvage. In the PPI judgement of April 2011 the High Court backed the requirement from the FSA that the Financial Services Industry must not only stop perpetrating the PPI rip-off, but must compensate all victims, including those who haven’t complained, from the start of their ripping.

The banks will fight to hold on to their historic right to be able to do things that are plainly wrong, on the basis that

- They didn’t break the rules, and can keep all their profits up to the time the rules are changed.

- They only have to compensate people who complain. Those who don’t complain, either because they don’t realise they have been ripped off or because it simply isn’t in their nature to complain, can get stuffed.

Was it obvious that PPI was being sold in a “wrong” way? Quite apart from the mis-selling of PPI to people who weren’t eligible – including the self-employed and those with pre-existing medical conditions - the sheer blatancy of the rip-off is evident from the astronomical profit margin. And the fact that the actual cost to the consumer is more than double the true cost of the insurance.

Companies that sell PPI (the “distributors”, such as the banks) to the customer don’t provide the insurance, they just take a generous commission. The actual insurance is provided by underwriters, insurance companies, who take less than 50% of what the consumer has paid. The following extracts are from the Competition Commission’s report of July 2008:

- In 2006 customers in the UK paid £4.4 billion in premiums [Gross Written Premium, GWP] to be covered by PPI policies.

- Distributors are contractually entitled to a percentage of this GWP - the amount of money paid by customers, net of insurance premium tax - as commission, to cover expenses and contribute to profits. Typical commission rates are 50 to 80 per cent for PLPPI [personal loans] and CCPPI [credit cards] and 40 to 65 per cent for MPPI [mortgages].

- The remaining GWP is passed to the underwriter to cover expenses, including claims. We found that between 11 and 28 per cent of GWP is paid out in claims, depending on the product.

The underwriters, who would pay any claims made on the policies, are so confident that even their minority share of the GWP is more than they are likely to need entered into an agreement to pass some of it back to the distributors:

- In the event that claims levels are less than expected, the resulting profit is generally split between the underwriter and distributor according to an agreed profit share percentage; typically 90 to 100 per cent in favour of the distributor.

- A separate profit share arrangement will typically apply to any investment income earned by the underwriter on premium income and may also apply to tax benefits on life business.

The Return on Equity (RoE, a measure of how profitable a business is) of banks, which are among the most profitable of organisations, is typically 15-25%. For PPI the RoE is 490% (four hundred and ninety, in case you thought this was a typing error). Twenty times more profitable, in an industry already infamous for excessive profit!

The banks aren’t fighting to prove they weren’t ripping off their customers selling PPI. The fightback is to protect the right to walk away with the profit once they’ve been caught out. That PPI is a rip-off is something even a banker would feel ridiculous denying. This must be clear even to them from the rate at which complaints against them are being upheld:

- Black Horse Ltd (part of Lloyds TSB) - 89%

- The Co-operative bank - 88%

- Lloyds TSB - 88%

- MBNA - 86%

- Firstplus plc (part of Barclays) 86%

- Tesco personal finance - 84%

- Barclays - 75%

- Natwest - 72%

- RBS - 69%

Paying back £5billion plus in ripped-off PPI premium is something that would hardly dent the bonus budget. But having to pay back ripped-off money from the past, and just as bad, also paying back money to people who haven’t even complained would set a dangerous precedent. According to the High Court judgement of April 2011, the number of people who have been tricked into thinking they weren’t ripped off, and people who simply didn’t get round to complaining could amount to millions:

There were between 3.8m and 11.3m non-complainant customers who might be contacted, and 15m who might be assessed for initial mailing by the firms.

Now that would hurt! The British Bankers’ Association makes this clear in their statement

It would hurt because it sets a dangerous precedent for the banks, and a hopeful one for the rest of us, that would

1) threaten reopening £billions of mis-selling cases from the past, not only PPI related

But far worse than that for the bankers - and a shining ray of hope for us - it would change the whole basis of the financial industry:

2) make it unattractive to continue with the currently ongoing chicanery, such as rip-off pensions, which are many many times bigger than PPI. As they would have to disgorge all their ill-gotten loot, rather than just what they took after being caught.

3) force banks and insurers to compete on quality products and services to earn their profits, rather than collude on rip-offs.

Three things that are to Financial Services like garlic, sunlight, and a wooden stake to a vampire.

PPI will doubtless return to the spotlight in a few months time when the banks appeal to the Supreme Court, as they did with the rip-off overdraft charges. They will find an expensive lawyer who will finesse the words of the law, trampling on its spirit, as they did with the rip-off overdraft charges. Influenced by the quality of the judges’ lunch and the humour of their spouses, their honours may come up with a decision as perverse as they did with the rip-off overdraft charges – in which they decided that regardless of the rip-off it was not the job of the Office of Fair Trading to investigate whether the banks were trading fairly.

British Supreme Court judgement in November 2009 on rip-off bank charges, in which the OFT having won its case through the High Court, ultimately lost in the Supreme Court.

Could it be that this is going to change? Could it be that the regulators, legislators and courts have found their courage? Alas, history suggests probably not. But who can tell!

Bankers carefully cultivate the illusion that their massive profits come from being really very clever. The reality is that billions of profits come from brutish scams such as

- Payment Protection Insurance

- Net Credit Interest (the gap between high loan rates and derisory savings rates)

- Rip-off pensions

- Unauthorised overdraft charges

Which is all necessary, the bankers tell us to the nodding of government ministers past and present, to keep the economy going round.

Friday, 22 April 2011

Friday, April 22, 2011

Posted by Jake

No comments

Labels: banks, British Bankers Assoc, FSA, insurance

Wednesday, 20 April 2011

Wednesday, April 20, 2011

Posted by Jake

No comments

Labels: budget cuts, credit crunch, inequality, retailers

Monday, 18 April 2011

Sunday, 17 April 2011

As you approach retirement, having spent the final years of your career dragging your aging bones into office to be bossed around by juveniles three decades younger than you, a letter will land on your doormat. The letter will contain a number, which may look rather large, and an offer which probably looks stunningly small.

I’d say £250,000 was a lot of money. If I’d won that in the lottery I’d get a mention in the local paper. I’d be thinking of a new car, a holiday or three, a few pairs of handmade shoes, and a mixed case of really good single malt whiskies.

If your pension fund, which is what the letter is about, is worth £250,000, that would buy you and your spouse an index linked income of around £8,000 per year. If this is your only income, then this puts you in the official definition of absolute poverty.

Poverty = below 60% of the Median income.

Absolute Poverty = below 40% of the Median income

2009 Median income = £489 per week = £25,428 per year.

Poverty = £15,257 per year

Absolute Poverty = £10,171 per year

(Figures for 2009)

If you qualify for the basic government pension for a married couple, of £163.35 per week (£8,494 per year), then you will be propelled from absolute poverty into a little above the 2009 'ordinary' poverty line.

What is gob-smackingly cynical of the pension companies is that they hope you will just sign at the bottom of the paper they sent you, and take their offer.

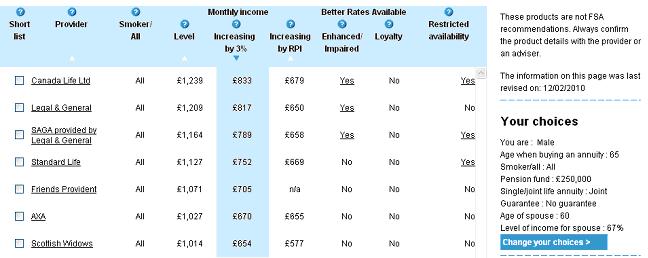

The pension companies are hoping with good reason that most people on the verge of taking a pension don’t understand annuities and don't know that they are allowed to take the "open market option" to buy an annuity from another provider. And those pensioners that do know this don’t know how to check annuity rates on the internet. The pension companies bet that it is far more profitable for them to spend money on advertising than to give the money to the pensioners. The two most highly advertised pension providers in the UK are probably AXA and Scottish Widows. These two companies were offering some of the most dreadful annuities, as could once be seen from the FSA backed comparison website, www.moneyadviceservice.org.uk. Both AXA and Scottish Widows now decline to be included in this website. Could it be because they are shy, or perhaps some other reason?:

As some providers are very small or offer specialist services, they have quite reasonably asked not to be included in the tables. But some larger providers have also chosen not to provide information for our tables at present

http://www.moneyadviceservice.org.uk/tables/

http://www.moneyadviceservice.org.uk/tables/

http://www.moneyadviceservice.org.uk/tables/ (taken in April 2011).

http://www.fsa.gov.uk/tables/ (taken in February 2010).

There is a reason the dark lady in the Scottish Widows adverts looks so smug - she isn’t smiling for you! However, lets use these 2010 figures to see what the effect is on your pension income.

To fully appreciate the horror of the gap between best and worse, just take a look at the impact on your income over 20 years, assuming you took the “level” income option, which stays the same for the whole period. Over 20 years, the Canada Life offering would pay you £297,360:

Choosing Scottish Widows or AXA over Canada Life, using the 2010 figures, would cost you over £50,000 during the 20 years.

Future Proofing:

The Annuities rip-off doesn’t stop there. There is the insurance company’s tempting offer – “Would you like to ‘future proof’ your pension?". You start with a lower income, but it increases by 3% each year for the rest of your life!” Increasing Pension sounds great, doesn’t it? Until you take a closer look.

“Level” means you agree to the same monthly income, with no increases, for the rest of your life. If you want the “increase by 3%” option, you have to accept a lower monthly income from year one, which will gradually grow from there.

Using the Scottish Widows figures from 2010: A closer look at the figures shows that with the “increasing” pension you actually get a major drop in income for the first 15 years. In the first year, you receive £12,168 with the 'level' option, but you would get only £7,848 with the '3% Growth' option.

Taking another view, if you see how much you receive altogether accumulated over the years, it takes nearly 29 years for you to catch-up.

For the first 15 years you are getting less income each month. After 15 years you will have received a cumulative total of over £35,000 less. It takes a total of 29 years for you just to get back what you lost in the first 15 years! If you retired at 65, you would be 94 before you could upgrade your Zimmer with your “increased” cash. Evidently More is Less in financial as well as architectural circles.

So how much pensions wealth is there to be ripped off? If you thought most of the population’s wealth was tied up in property you’d be almost wrong. An equal amount is tied up in pensions – which is why pensions shenanigans are one of the great profit makers for the financial services.

(Page 44, http://www.fsa.gov.uk/pubs/other/rcro.pdf)

Having had up to half your savings swiped by fund management charges, the pension companies take further bites from your pension when you buy your annuity. Finance companies are masters in misleading by telling the truth – their tactic of choice when running circles around customers and regulators. In 2008 the FSA complained about the literature provided to those approaching retirement:

- On key features documents ….we reported in September last year that only 15% of a sample of just over 200 documents complied with our Principles and rules.

- a disappointing 40% of the wake-up packs we reviewed failed to meet regulatory requirements

- research suggesting a gap of around 20% between the top and bottom annuity rates (not including enhanced and impaired annuity rates)

Despondent statements of disappointment by regulators make no difference to the financial services industry. We can only wait until a politician in a position of power shows the guts to do something, and parliament shows the courage to follow through.

But don't hold your breath. To paraphrase Albert Einstein:

"Only two three things are infinite, the universe, and human stupidity, and corporate greed, and I'm not sure about the former first."

Friday, 15 April 2011

Friday, April 15, 2011

Posted by Jake

No comments

Labels: credit crunch, inequality, retailers, sales techniques

Wednesday, 13 April 2011

Wednesday, April 13, 2011

Posted by Jake

No comments

Labels: banks, credit crunch, inequality, jobs, pay, regulation, taxation, the government

Monday, 11 April 2011

Monday, April 11, 2011

Posted by Jake

No comments

Labels: banks, Bonus, budget cuts, credit crunch, FSA, inequality, pay, regulation, taxation

Sunday, 10 April 2011

The government and the pension industry are continually preaching to us that we are saving too little. They deploy vast advertising and advisory budgets to get this particular gospel across to us. You’ll be doomed if you don’t save, they tell us, but there is a nagging suspicion that we will be doomed if we do save too.

It would be unfair to say government and pension fund managers are entirely in cahoots. Each have their own separate reasoning for their common cause:

a) The government, so it can transfer the blame for pensioner poverty to the pensioners, for not saving enough. A low cost and curt “I did warn you!” is much cheaper than actually doing something about it. It’s a tactic from the same handbook as putting “Smoking Kills” on packets of cigarettes – nothing to do with warning the smoker, everything to do with providing an “I told you so” defence in compensation court.

b) The pension industry so it can rip us off. The impact of pension fund charges, which typically range between 0.5% and 5%, can slash your savings by over 50%. For a prudent young person planning for the future thus;

- 25 years old, planning to contribute for 40 years until they are 65

- £100 per month, increasing by 3% each year

- Fund growing at 6% per year

A report by the RSA (Royal Society for the encouragement of Arts, Manufactures and Commerce) found that a reasonable charge would be 0.5%, and that excessive charges in the UK meant:

Let’s put the government to one side and focus on the pensions industry, for now. The government will wait for another time. You need a bit of mathematics to explain what is possibly the widest reaching, most chronic, and most ruthless rip-off of them all. To be more precise, widest reaching, most chronic, and most ruthless sequence of rip-offs. “Sequence”, because you are ripped off during every stage of your life.

STEP 1. As a worker: to get the tax benefits you are required to save for your pension with ‘regulated’ providers. If you take all the money you save, plus the returns on the investment, over a working life of 40 years, you will find the provider takes up to half of it in charges.

STEP 2. On retirement: or by the time you are 77, you are required to buy an annuity. You take all the money you saved during your life, and you give it to a pension company. In return they will give you an annual amount which will be as paltry as they can get away with. The pension company will, by default, give you a terrible return. They will try to bamboozle you with ‘future proofed’ pensions that grow with time. Omitting to tell you that 'future proofing' means you start with about a third less monthly income, and it will probably take a couple of decades to catch up with amount you would have got with a non-future-proofed pension. The maths, which I will explain in a future post, shows that if you take your future-proofed pension at 65 you could be over 90 before you see any extra cash.

STEP 3. On passing away: Having retired and bought an annuity, when you die your pension stops and your pension fund is taken by the provider. If you invested £500,000 with them, and you lived for 1 day or for 10 years drawing at a rate of £25,000 a year – then when you die, the remaining money becomes the property of the pension provider.

STEP 0 (this rip-off is cyclical). As a child: the wealth your parents built up for their retirement, their savings built up by skimping on your holidays, sweeties, birthday presents, and private education, is grabbed when they pass away. Not a farthing of the money they used to buy the annuity for their old age will you find in the inheritance carve-up.

For this week, I will concentrate on STEP 1, the charges, leaving STEP 2, 3 and 0 for future weeks. Fund management is perhaps one of the greatest financial rip-offs in current times. If the government is actually serious about reining in bankers’ bumper bonuses, they don’t need to put caps on remuneration. They simply need to control the contribution rip-offs make to bank profits – deflating that particular balloon would go a long way to bringing the bonuses down to earth.

Investment funds in the UK typically charge anything between 0.5% and 5% per annum to provide their service. At first it doesn’t sound so much. After all, at a restaurant you would typically leave a 10% service charge for the waiter. But the investment fund takes their service charge every year. It’s as if the waiter is sitting at the table with you eating your lunch. In the world of pension funds, you pay for your meal during the meal, but only get to eat your share once the waiter has finished – that is to say when you retire and get your pension payments.

For those who do invest in pension and other funds, taking a closer look at the mathematics of a mid-level 2% per annum investment fund charge reveals the catastrophic impact of the charge on a 40 year investment. The maths also reveals a further well hidden cost of the charges, on top of the charges themselves:

- You earn interest on the amount you have invested.

- When you pay a charge, the amount you have invested is reduced.

- Therefore the cost to you is not only the accumulated charges, but also the lost investment income that would have accrued had those charges not been made.

- Effectively, the money you are charged has moved to someone else’s account and is earning them interest instead of you.

To keep things simple, here is an illustration if you made a single £1,000 investment and made no further contributions.

After 40 years, earning 6% and paying a charge of 2% per annum, the £1,000 is worth £4,584 and the accumulated charges over this period have been £1,848. However, the removal of the £1,848 over the 40 years has also resulted in a loss of a further £3,854 in investment income if you had kept that £1,848. So the total cost to you is £1,848 + £3,854 = £5,702 – more than halving what your investment would have been worth without any charges.

Could it be that the fund manager is worth the cost of his hire? There is an ongoing debate around whether passive Index Tracking funds can be beaten by actively managed funds in which ‘clever’, i.e. highly paid, fund managers duck and dive between stocks and cash striving to win extra profits. However the overall statistics show that over a period of 5 years, Index Tracking beats the great majority of actively managed funds. Standard & Poor’s (S&P), a financial research company, produces a quarterly report the S&P Indices versus Active Funds Scorecard (SPIVA). The SPIVA report for North American funds in the year 2008 stated

- Over the five year market cycle from 2004 to 2008, the S&P 500 index outperformed 71.9% of actively managed large cap funds, S&P MidCap 400 outperformed 79.1% of mid cap funds and S&P SmallCap 600 outperformed 85.5% of small cap funds. These results are similar to that of the previous five year cycle from 1999 to 2003.

- The belief that bear markets favor active management is a myth. A majority of active funds in eight of the nine domestic equity style boxes were outperformed by indices in the negative markets of 2008. The bear market of 2000 to 2002 showed similar outcomes.

- Benchmark indices outperformed a majority of actively managed fixed income funds in all categories over a five-year horizon. Five year benchmark shortfall ranges from 2-3% per annum for municipal bond funds to 1-5% per annum for investment grade bond funds.

- The script was similar for non-U.S. equity funds, with indices outperforming a majority of actively managed non-U.S. equity funds over the past five years

Over the last 10 years the FTSE Index has matched or outperformed the expensive fund’s own index tracker as well as its actively managed fund.

All the talk by government and the pensions industry about Ripped-off Britons working longer and living leaner is missing one big point. By stopping the fund managers ripping out 50% of the value of pension funds, you can at a stroke make a giant stride towards dealing with the pension crisis. And also make a giant stride towards dealing with excessive pay in the financial services industry.

Tuesday, 5 April 2011

Reality: Barclays admitted that of the £2billion taxes they took credit for, only £113m was corporation tax. The rest was taxes paid by their staff - the vast majority of whom would remain in the UK even if Barclays shifted its HQ overseas.

The Independent Banking Commission's interim report, in April 2011, stated that only £3billion of financial services tax contribution can easily be moved out of the UK. That is less than 1% of UK tax takings.

The Independent Banking Commission's interim report, in April 2011, stated that only £3billion of financial services tax contribution can easily be moved out of the UK. That is less than 1% of UK tax takings.

Monday, 4 April 2011

Monday, April 04, 2011

Posted by Jake

No comments

Labels: budget cuts, credit crunch, inequality, jobs, supermarkets

Sunday, 3 April 2011

There are few actions under the sky that cannot be spun and woven into a tissue of good intentions. Even the most wicked action can have a benevolent reason behind it. Whipping a horse may be to prove it is still a good runner, and save it from the glue factory. Inflicting pain and death on laboratory animals may result in the development of medical products and procedures to improve health, or test cosmetics which make your loved ones less…well…ugly. The political decision to massacre a civilian population may save more lives by the bloody example hastening the end of a war. Monstrous individuals through history and fiction have excused themselves as being resolute bulwarks against greater monstrosities.

Among those few actions that can have no benevolent purpose whatsoever, other than enriching the perpetrators, is the habit of banks quietly cutting interest rates on savings accounts. Not quite none whatsoever. This does have one positive result – providing one of the clear pieces of evidence of the complicity between regulators and the financial services industry.

As we enter the start of the new financial year, Banks offer eye-catching interest rates on Cash ISAs that last for the first 12 months, and are then cut to as little as 0.05%. The teaser rate is advertised in large font and eye-grabbing colour, and the reduction is announced quietly, if at all, in the form of an email. The impact of this can devastate what should be a great way of saving:

Using the average savings interest rates for each year since 1999, a saver investing the Cash ISA limit of £3,000 in that year would have earned £1,976.81. Using the banks’ scam of dropping the interest rate to 0.1% after the first year, the saver would have earned just £162.05. By this scam, the saver has lost £1,814.73, or 92% of his income.

The figures for a saver who invested her full allowance in a Cash ISA each year since 1999 would be:

- Interest earned, being paid the average savings account interest for each year

- £11,739

- Interest earned, being paid the average savings account interest only for the first year, and 0.1% for subsequent years

- £1,916

- A loss of

- £9,823

The basis of the Orifice of Fair Trading’s dismal record can be seen in black and white in the reasoning of their decision to do nothing about this rip-off:

- information on interest rates is readily available to those consumers who want to find it online, at branches and over the telephone, but most consumers do not know what their interest rate is

- From 1 May 2010, most consumers have received notification when any bonus rate period ends. The notification of the end of bonus rates does not apply to those cash ISAs designated as 'payment accounts'.

- At the time of writing, only a limited number [around 15 percent] of the major cash ISA providers place interest rate information on cash ISA statements.

- 83% of consumers questioned in our survey have never transferred their Cash ISA

Perhaps the OFT team saw it as a great victory when they got an undertaking from the British Bankers Association to

Perhaps the team decided not to dwell on Mervyn King, the Governor of the Bank of England’s, comment about banks the tactics of the british banking sector:

“if it’s possible to make money out of gullible or unsuspecting customers, particularly institutional customers, that is perfectly acceptable”.

Or Sir Howard Davies, outgoing Chairman of the FSA in 2003, who said

Or Peter Vickery-Smith, the chief executive of Which?, the leading UK consumer affairs organisation, who commented in January 2011 about financial services

Perhaps, thanking the Bankers for this kick in the crotch of the pants, the OFT team took the tradesmen’s exit and slunk back to their office of fair trading to draft their courageous decision:

The OFT think it is inappropriate to require cash ISA providers to automatically transfer consumers off the 0.1% rates? In heavens name why is it inappropriate? There is no complexity here. Just a rip-off.

Consumers in Britain are regarded by the OFT as fair game. So long as information is made available it doesn’t need to be made accessible.

Q: How do you know if information is available?

A: By seeing if people can in principle get to it.

Q: How do you know if information is accessible?

A: By seeing if people actually access it. The OFT’s own statement “most consumers do not know what their interest rate is” proves it is not accessible.

For the OFT, Available but not Accessible = Acceptable.

For the banks, Kerching!

For the banks, Kerching!

What is the size of this problem? According to the Consumer Focus super-complaint

- About a third of the population has Cash ISA accounts

- This amounts to about £158billion in total

- They are losing between £1.5billion to £3billion per year

What reason is there for a saver to want to leave their cash in an account paying derisory interest? There is no purpose like the saver making a choice on ‘risk aversion’ or ‘ethics’ or stuff like that. All the product does is pay interest. There is precisely zero reason anyone would choose to do this.

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

Priority

property

protests

public sector

Puppets

Ready

regulation

retailers

Roundup

sales techniques

series

SFO

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

UK Uncut

unions

Vince

water

Archive

-

▼

2011

(185)

-

▼

April

(17)

- Royal wedding: British culture with German origins

- Internships – a moral dilemma

- Payment Protection Insurance: bankers appeal to pr...

- High Court ruling leaves consumers feeling H-a-PPI

- A royal wedding is just the tonic … economically

- Hotels: compare and dry

- Pensions - having already swiped 50% of your savin...

- What a plonker!

- Quitting the UK? Don't bank on it

- Banks eye up relocation, relocation, relocation

- Pensions - how fund management charges swipe 50% o...

- Working from home, and why it's not for all

- Isa rate ruses are a con

- Liebrary: With proper bank regulation and some ban...

- Every Lidl helps

- Cash ISAs: How banks can pinch 92% of your savings...

- Transport troubles

-

▼

April

(17)

Powered by Blogger.