As you approach retirement, having spent the final years of your career dragging your aging bones into office to be bossed around by juveniles three decades younger than you, a letter will land on your doormat. The letter will contain a number, which may look rather large, and an offer which probably looks stunningly small.

I’d say £250,000 was a lot of money. If I’d won that in the lottery I’d get a mention in the local paper. I’d be thinking of a new car, a holiday or three, a few pairs of handmade shoes, and a mixed case of really good single malt whiskies.

If your pension fund, which is what the letter is about, is worth £250,000, that would buy you and your spouse an index linked income of around £8,000 per year. If this is your only income, then this puts you in the official definition of absolute poverty.

Poverty = below 60% of the Median income.

Absolute Poverty = below 40% of the Median income

2009 Median income = £489 per week = £25,428 per year.

Poverty = £15,257 per year

Absolute Poverty = £10,171 per year

(Figures for 2009)

If you qualify for the basic government pension for a married couple, of £163.35 per week (£8,494 per year), then you will be propelled from absolute poverty into a little above the 2009 'ordinary' poverty line.

What is gob-smackingly cynical of the pension companies is that they hope you will just sign at the bottom of the paper they sent you, and take their offer.

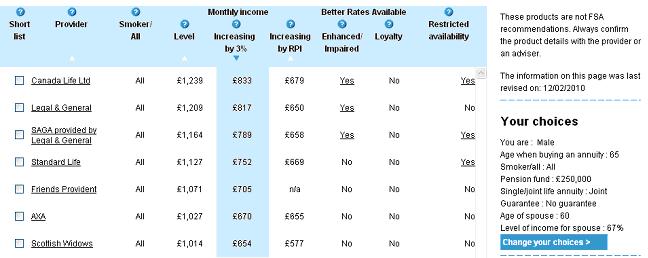

The pension companies are hoping with good reason that most people on the verge of taking a pension don’t understand annuities and don't know that they are allowed to take the "open market option" to buy an annuity from another provider. And those pensioners that do know this don’t know how to check annuity rates on the internet. The pension companies bet that it is far more profitable for them to spend money on advertising than to give the money to the pensioners. The two most highly advertised pension providers in the UK are probably AXA and Scottish Widows. These two companies were offering some of the most dreadful annuities, as could once be seen from the FSA backed comparison website, www.moneyadviceservice.org.uk. Both AXA and Scottish Widows now decline to be included in this website. Could it be because they are shy, or perhaps some other reason?:

As some providers are very small or offer specialist services, they have quite reasonably asked not to be included in the tables. But some larger providers have also chosen not to provide information for our tables at present

http://www.moneyadviceservice.org.uk/tables/

http://www.moneyadviceservice.org.uk/tables/

http://www.moneyadviceservice.org.uk/tables/ (taken in April 2011).

http://www.fsa.gov.uk/tables/ (taken in February 2010).

There is a reason the dark lady in the Scottish Widows adverts looks so smug - she isn’t smiling for you! However, lets use these 2010 figures to see what the effect is on your pension income.

To fully appreciate the horror of the gap between best and worse, just take a look at the impact on your income over 20 years, assuming you took the “level” income option, which stays the same for the whole period. Over 20 years, the Canada Life offering would pay you £297,360:

Choosing Scottish Widows or AXA over Canada Life, using the 2010 figures, would cost you over £50,000 during the 20 years.

Future Proofing:

The Annuities rip-off doesn’t stop there. There is the insurance company’s tempting offer – “Would you like to ‘future proof’ your pension?". You start with a lower income, but it increases by 3% each year for the rest of your life!” Increasing Pension sounds great, doesn’t it? Until you take a closer look.

“Level” means you agree to the same monthly income, with no increases, for the rest of your life. If you want the “increase by 3%” option, you have to accept a lower monthly income from year one, which will gradually grow from there.

Using the Scottish Widows figures from 2010: A closer look at the figures shows that with the “increasing” pension you actually get a major drop in income for the first 15 years. In the first year, you receive £12,168 with the 'level' option, but you would get only £7,848 with the '3% Growth' option.

Taking another view, if you see how much you receive altogether accumulated over the years, it takes nearly 29 years for you to catch-up.

For the first 15 years you are getting less income each month. After 15 years you will have received a cumulative total of over £35,000 less. It takes a total of 29 years for you just to get back what you lost in the first 15 years! If you retired at 65, you would be 94 before you could upgrade your Zimmer with your “increased” cash. Evidently More is Less in financial as well as architectural circles.

So how much pensions wealth is there to be ripped off? If you thought most of the population’s wealth was tied up in property you’d be almost wrong. An equal amount is tied up in pensions – which is why pensions shenanigans are one of the great profit makers for the financial services.

(Page 44, http://www.fsa.gov.uk/pubs/other/rcro.pdf)

Having had up to half your savings swiped by fund management charges, the pension companies take further bites from your pension when you buy your annuity. Finance companies are masters in misleading by telling the truth – their tactic of choice when running circles around customers and regulators. In 2008 the FSA complained about the literature provided to those approaching retirement:

- On key features documents ….we reported in September last year that only 15% of a sample of just over 200 documents complied with our Principles and rules.

- a disappointing 40% of the wake-up packs we reviewed failed to meet regulatory requirements

- research suggesting a gap of around 20% between the top and bottom annuity rates (not including enhanced and impaired annuity rates)

Despondent statements of disappointment by regulators make no difference to the financial services industry. We can only wait until a politician in a position of power shows the guts to do something, and parliament shows the courage to follow through.

But don't hold your breath. To paraphrase Albert Einstein:

"Only two three things are infinite, the universe, and human stupidity, and corporate greed, and I'm not sure about the former first."

What an eye opener!

ReplyDeleteThe truth is in the mathematics!

ReplyDeleteDaily Mail report on annuity rip-off by RBS and Aviva: "Salesman allowed dying man to sign away £500,000 on a pension that would never pay out"

ReplyDeleteRead more: http://www.thisismoney.co.uk/money/investing/article-2073736/Salesman-allowed-dying-man-sign-away-500-000-pension-pay-out.html#ixzz1grpzeux1

The Guardian reports:

ReplyDelete"Worst UK pension providers named: Scottish Widows, Clerical Medical and Royal & Sun Alliance among worst value annuity providers, according to ABI data.

The worst standard annuities

The retirement income offered per year by a pension provider to a 65-year-old who has saved £18,000 …

Scottish Widows/Clerical Medical/Halifax: £839.52

NFU Mutual: £890.76

Wesleyan Assurance Society: £905.16

Phoenix: £910.00

The best standard annuities

Canada Life: £1,077.24

Aviva: £1,080.36

Reassure: £1,092.36

Reliance Mutual: £1,099.92

Source: ABI. Based on annuity quote for a single life, no health problems, living in Manchester area"

Link to Guardian report on worst annuity providers

Deletehttp://www.theguardian.com/money/2013/aug/21/worst-uk-pension-annuity-named-abi