Posted by Jake on Saturday, September 17, 2011 with 5 comments | Labels: Article, banks, Bonus, British Bankers Assoc, pay, taxation

We judge doctors not by their own health, but by the health of their customers - their patients.

We judge teachers not by their own erudition, but by the accomplishments of their customers - their students.

Why is it that we judge bankers by their own wealth, and not by the wealth of their customers - us?

Why does Britain celebrate, nurture and protect the wealth of bankers, while putting up with miserable investment returns, pitiless rip-offs, and economy crushing bank-bailouts?

Rip-offs in the financial sector, such as the Great Payment Protection Insurance Scam, have triggered a landslide of rip-offs in the rest of the economy. With the bankers having set the pace, executives in other industries greedily follow. Their logic being:

- Bankers are paid loads more than me

- I am as valuable as a banker

- I should be paid loads more than I am

Forgetting that highwaymen don’t take your money because they are worth it but because they can, they overlook the other logical conclusion:

- Bankers are paid loads more than me

- I am as valuable as a banker

- They should be paid loads less than they are

Executives across the land quickly realised the easiest way they can keep up with the bankers is to join in the ripping-off. Energy companies pushing up prices in-spite of record profits; telecoms companies fibbing about broadband speeds; suppliers ripping-off the government charging £22 for a 65p lightbulb. Even our much loved family doctors, finer fellows than those bankers, made a successful grab for a bumper payrise with a cunningly negotiated contract.

National Audit Office, review of GP contracts, 28th February 2008

Bankers give one single prime reason for “having” to pay themselves grotesque salaries. They plead the need to recruit and retain the best of the best, to stem the 'talent drain'. Bankers argue that if it weren’t for the risk of them being tempted away by other even more grotesque salaries, they wouldn’t be forced into being so grotesque about paying themselves. It's not their own fault, it's the other bankers' fault.

So, is all this business about ‘the best of the best’ actually true? We can use mathematics, in the form of basic "teenager level" probability theory, to reveal all. With the help of some baboons, pictures compliments of the Wikimedia Commons, and some tweaking by ourselves.

If 100 baboons entered a contest to play a Bach fugue on the piano, would half of them be better than average? The maths will reveal all about both baboons and bankers.

Answer: Yes, assuming they all have to be ranked separately, i.e. they can’t all be judged “equally (in)competent”. (Mathematical pedants would point out that if one baboon was judged to be first, and the other 99 to be equal second, then only one baboon would be above average).

Under these conditions, assuming all the monkeys were roughly equally skilled, and their ranking in the contest was just random chance, the chances of a baboon getting into the top 50% three times in a row would be one chance in eight, or 12.5% (maths is explained a little further down).

Now, lets compare the baboons with fund managers. “Masters of the Universe” who claim that they must be paid fabulous money because they are so excellent. What do their actual results say? Like the best athletes you would have thought the ‘best’ bankers would be able to get at least into the top quarter almost every time.

Using pure random chance, equivalent to a baboon, the probability of coming in the top quarter of a group is

Compare this with the actual performance of the funds, using Thames River’s Fund Watch which monitors how consistently funds perform:

Just 16 funds out of 1,188 in the Thames River figures for the first quarter of 2011 made it into the top 25% three years in a row. That’s 1.3%, which is close to what you would expect from pure random chance.

Let’s lower the bar. Forget top 25%, surely the ‘best of the best’ can get into the top 50% three years in a row? Looking at the Thames River figures, just 8.6% of funds achieved this.

Let’s compare this with pure random chance:

Again, we see the fund managers achieving something worse than random chance.

Perhaps the fund managers don’t stay ahead of the pack because they are all equally excellent? If that were so

- Why are returns on investments and interest paid on savings so pathetic?

- Why do they plunge the world into financial crisis a couple of times every decade?

But let’s work on that theory in any case. After all, if all tennis players were as superb as Rafael Nadal (number 1 in the world for much of 2010/2011), then the probability of any one of them getting into the top half of the rankings would also be 50%.

To know if all the bankers are veritable battalions of banking Nadals, we only need to measure them against all the other ordinary investors – including the likes of you and me. This can be done by comparing them with the stock market indices, which indicates the average for all investors.

The Standard & Poor’s Index vs Active Funds (SPIVA) report shows that overall, actively managed funds do no better than the stock market index trackers. In fact, the overall statistics show that over a period of 5 years, Index Tracking beats the great majority of actively managed funds. The SPIVA report for North American funds in the year 2008, covering the period before and during the crash of that year, is particularly telling, stating:

· Over the five year market cycle from 2004 to 2008, S&P 500 outperformed 71.9% of actively managed large cap funds, S&P MidCap 400 outperformed 79.1% of mid cap funds and S&P SmallCap 600 outperformed 85.5% of small cap funds. These results are similar to that of the previous five year cycle from 1999 to 2003.

· The belief that bear markets favour active management is a myth. A majority of active funds in eight of the nine domestic equity style boxes were outperformed by indices in the negative markets of 2008. The bear market of 2000 to 2002 showed similar outcomes.

· Benchmark indices outperformed a majority of actively managed fixed income funds in all categories over a five-year horizon. Five year benchmark shortfall ranges from 2-3% per annum for municipal bond funds to 1-5% per annum for investment grade bond funds.

· The script was similar for non-U.S. equity funds, with indices outperforming a majority of actively managed non-U.S. equity funds over the past five years

The scorecards for 2009 and 2010 show similar results, with actively managed funds doing painfully averagely. Index funds that can be administered by a trainee accountant on £25k a year, simply tracking the market indices – such as the FTSE100, S&P500, and the like – performs as well as the multimillionaire fund managers.

So, we see that

a) there is no ‘best of the best’. Fund manager performance matches what you would get from random chance.

b) Fund manager performance overall does worse than the average for the whole markets overall.

With fund managers all much of a muchness, there is no valid reason that would benefit us customers to tempt them with pots of money away from other banks. There is only a need to pay them amounts of money to compete with other professions that may tempt him away from banking. So, how much would that be?

- Drop his pay from £1million to £500,000 and the banker could be tempted away to play in a premier league football team. If he had the talent.

- Drop his pay from £1million to £250,000, and the banker could be tempted away to be a consultant surgeon in one of the London hospitals. If he had the talent.

- Drop his pay from £1million to £125,000, and the banker could be tempted away to sit in the chair of a professor of theoretical physics at Cambridge. If he had the talent.

- Drop his pay from £1million to £62,500, and the banker could be tempted away to be a programmer in a software company. If he had the talent.

- Drop his pay from £1million to £31,250, and the banker could be tempted away to be a teacher in an inner-city comprehensive school. If he had the talent.

The statistics show no evidence that bankers are the best, and a history of boom and bust suggests that they are more Calamity Janes and Crisis Joes. In-spite of this the FSA revealed that more than 2,800 people in the City of London’s financial sector took home more than £1million in 2009.

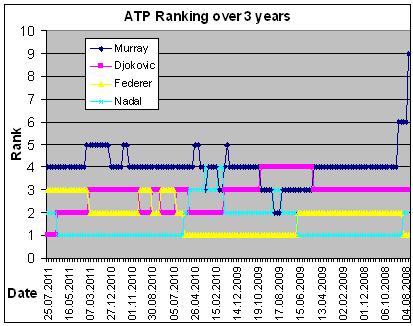

To see what ‘best of the best’ actually means, look at other high profile professions. Take tennis as an example. The top four tennis players as at July 2011 are Djokovic; Nadal; Federer; Murray. Of these four, only Andy Murray has fallen below 4th place in the last 3 years – and even he stayed in the top 10 for that whole period.

These four players have earned career average annual prizes of between US$3million and US$5million.

Compare that with 2,800 bankers in London took home more than £1m (US$1.6) in 2009.

Then compare the bankers with the ATP tennis players. The amount of prize money earned in 2011 up to the end of July by the 1,800th ranked player (close to the last in the list) was US$519. Five hundred and nineteen dollars.

To earn that US$519, the player was 1,000 places higher than one of those 2,800 City bankers paid £1m or more.

To earn that US$519, the player was 1,000 places higher than one of those 2,800 City bankers paid £1m or more.Of course, bankers’ pay could be cut to a fraction of what it is now, and they would have nowhere to go. The reality is that bankers look after themselves first. Moderating pay policies won’t happen without outside intervention.

There is a precedent. The law discourages individuals from mugging people in the streets and burglarising citizens’ houses. Excessive fees and charges, which pay for excessive bankers pay, are no different from mugging and burglary. Pinching citizens’ property, in the form of their savings and investments: up to 50% of a working lifetime’s saving into a pension can go in charges.

In the end, bankers can’t keep up their pay alone. It needs a combination of the cupidity of other bankers, the cowardliness of politicians, and the complicity of regulators.

In the end, bankers can’t keep up their pay alone. It needs a combination of the cupidity of other bankers, the cowardliness of politicians, and the complicity of regulators. And, perhaps most of all, the complacency of the rest of us.

The “Arab Awakening”, ordinary people protesting in the streets, brought down in months oppressive regimes that had lasted decades. How about a “Ripped-Off Briton awakening”?

Dealing with excessive pay in the financial services would be a victory against rip-offs across Britain in every sector.

See report showing that Hedge Funds perform no better than average: http://www.blog.rippedoffbritons.com/2011/12/liebrary-hedge-funds-consistently.html

ReplyDeleteIsn't it high time to sign this petition "Split The Banks & Save The Nation (tax payer from any future bailouts of failed banks)

ReplyDeletehttps://www.change.org/petitions/ukparliament-split-the-banks-and-save-the-nation-from-future-bail-outs

Excellent little piece. Actually working with these "top bankers" (which I did many years ago) I understand how they operate. They believe that they "have a nose" for the market. They back their intuition concerning stocks and bonds that they "feel" will be profitable. They back up this notion with what sounds like reasoned arguments concerning how the market might proceed in future - all the while knowing that the "market" does not necessarily move according to their will. There are some clever investment managers; but like all professions, most are about average so their "intuitions" are usually about as accurate as anyone else's.

ReplyDelete.

ReplyDeleteTransparency is the one thing that bankers fear the most.

Why do you suppose they are so against the adoption of bitcoin ? There has been so much 'negative publicity' peddled about bitcoin that the public is , understandably, totally confused about the real nature of bitcoin;

The real Killer-Ap of bitcoin lies in its underlying protocol ( the mathematics that transports it within the internet - in the same way as STMP drives emails, or https drives websites )

This protocol is called the Blockchain Protocol and , despite what you may have been led to believe, is actually an open-source code where ALL transactions are recorded, and publicly visible - So - Bankers HATE bitcoin because it would expose exactly what they are doing, shows ALL movements of money, and "give away" their scams and fraud.

.

Letter to the FT by former boss of the investment bank Cazenove, referring to Barclays paying higher bonuses inspite of lower profits:

ReplyDeletehttp://www.ft.com/cms/s/2/74c31a78-cbc0-11e3-8ccf-00144feabdc0.html#axzz30I9FHIx0

"The problem obviously is that the management of investment banks, right up to the top, have an interest in perpetuating the myth of the death spiral in order to justify high pay. It is absolutely ingrained in the culture of these organisations and Mr Jenkins’ antagonists at BarCap in the US, having been schooled in the rough, tough world of Lehman Brothers, will be master exponents of the art form.

What is needed is an equally tough and experienced manager who is able to see these threats for what they are and face them down, even at the cost of some short-term disruption. It is possible that Mr Jenkins will prove his doubters wrong and come out on top, but from my armchair it looks like an unequal fight and my money would be on the investment bankers."