TOP STORIES

-

LATEST: Think you’re paying less tax now? The withdrawal of Working and Child Tax Credits leaves low earners paying a 73% marginal tax rate, and medium earners paying even more

...And this government says it cuts taxes for poor working households!

-

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST WEEK'S MEDIA

Drug firm Novartis tried to 'scupper' trials of a cheaper version of eye medicine

Has Austerity caused the UK’s first decline in life expectancy in 20 years?

Kellogg's effectively paid no corporation tax in the UK in 2013, +more stories...

-

YOU'RE FIRED?! We are already nearly the most easily fired people in the developed world

Only the US and Canada make it easier, says the OECD’s Worker Protection Index -

EYE OPENER: Housing Equity Withdrawal took off in 1979. Since then almost all UK growth has suspiciously equalled the amount we took out. Looks like it’s pensions next

Osborne’s new rules allow you to spend your entire pension pot now. Same mistake, different pot -

DID YOU KNOW? MPs are getting a 10% pay hike in May, to £74k

...and in 2010, 137 MPs put family members on parliament's payroll. Now it's soared to 167

CARTOONS

Wednesday, 29 February 2012

Wednesday, February 29, 2012

Posted by Jake

No comments

Labels: benefits, budget cuts, inequality, jobs, pay, protests

Sunday, 26 February 2012

Sunday, February 26, 2012

Posted by Jake

5 comments

Labels: Article, Bank of England, Guest, Inflation, pensions

By Dr.Ros Altmann, Director General of SAGA

Anyone recently or soon-to-be retired may be facing a stark reality - Bank of England policy is robbing them of the retirement they saved for. If Government had announced that, in order to bail out the banks and help those who have borrowed too much, it had decided to raid people's pensions, there would be uproar. But, by calling it 'Quantitative Easing', somehow it has got away with stealing older people's futures. QE is causing dreadful damage to pensions, pensioners and annuities and the impact is long-lasting. Of course, there are some lucky ones, with final salary pensions who are better off, but that is by far the minority.

I believe it is important for everyone to understand the almost impossible position facing older people around retirement today. They are suffering in silence so far, but for how much longer? There is simply nowhere for them to turn - they were led to believe that low rates and QE would be 'temporary' policies, but there is no end in sight to this massive inter-generational transfer.

Why is the Bank ignoring these terrible effects on pensioners? Is it because officials don't realise how many people are being hit and these older people do not have a powerful voice? Is it because most of those making monetary policy decisions have final salary pensions and, therefore, are protected from the impact of their own policies?

Most of those who have saved in a pension scheme, other than a final salary-type arrangement, will need to buy a pension income from their pension savings on retirement. They are suddenly finding that the Bank of England has stacked all the cards against them and there is often nothing they can do to protect themselves. Millions of people who saved diligently for their retirement are now bitterly disappointed with their situation. Such pension problems are being completely ignored by the Bank of England, but they will cause long-term economic damage. QE is supposed to be a temporary boost to the economy, but it is making many pensioners permanently poorer.

So why has QE been such a disaster for older people?

Annuity rates have fallen as a result of QE.

The majority of people with personal pensions (not final-salary type schemes) buy an annuity on retirement which provides their pension income. The amount of income they will receive from their accumulated pension savings is determined by the interest rates on Government bonds (gilts) - the lower the interest rate, the lower the pension income paid. As QE has focussed on buying gilts, this has forced up the prices and so lowered their interest rates, which has reduced annuity rates, so the pension income people can get from their pension savings has fallen sharply.

Before QE started in 2009, a £100,000 pension fund would buy an annuity (pension income for life) of around £7,000 a year. Now, as a result of the Bank of England forcing gilt interest rates down, a £100,000 pension fund would only buy an annuity pension income of around £5,800 a year. Once the annuity is bought, it lasts for the rest of the person's life, so the retiree will be permanently poorer for the rest of their life as a result of QE. This means they will have less money to spend and, with around half a million annuities sold each year, there will be a significant permanent reduction in spending power in our economy.

Pension companies often impose penalties on people who don't take their pension in their chosen date.

Some people coming up to retirement now may decide they don't want to take their annuity yet - due to the fall in rates, but would rather wait and see if rates improve. Some may want to take their annuity early because they fear rates will get even worse if the Bank does even more QE. All these people could find themselves in an impossible position. Pension companies often impose penalties on people who decide not to take their pension on the date they originally selected when they started their policy. Many people will have selected to retire on their 65th birthday. There are record numbers of people reaching 65 at the moment (due to the post-war baby boom) and they may, therefore, find they can only take their pension at age 65, or they will be penalised. They really are between a rock and a hard place.

Income Drawdown also hit by QE.

If someone decides they don't want to buy their annuity now, but would rather wait and hope that interest rates will go up again in future, they do have an option (depending on the size of their pension fund) to take a quarter of the fund as tax free cash and leave the rest of it in an income drawdown policy, from which they can take an income each year. However, the amount of income that they are allowed to withdraw from their pension fund is set by the Government Actuary's Department (GAD) and the lower the interest rates on gilts, the less the income people can withdraw from their own pension fund. (The aim of the restriction is to ensure people don't run out of money, but the fall in GAD rates means that pension incomes have fallen sharply following QE). So, if someone was able to take out £5,000 a year income from their pension fund before QE, the Bank of England's policy on gilt interest rates will mean they can now only take out around £4,000. Even if they had been living on the £5,000 a year in the past, their pension would now have to be cut to around £4,000 because of the new rates. That means they have less money to spend, of course, which will harm the economy.

Savings income has fallen sharply due to Bank of England policies.

As interest rates have fallen, older people living on their savings have suffered significantly. Many were relying on income from their savings to top up their pension income, but find that monetary policy has hit their savings as well as their pensions.

Company pension schemes hit badly by QE too.

Anyone with a final salary pension is much better off than those with other types of pension fund, however the companies running these schemes are being damaged by the effect of QE. The lower the interest rate on gilts, the worse pension fund deficits become because low gilt rates mean higher pension liabilities. Companies running such pension schemes have to make up the deficits and, as deficits grow, the sponsoring company has to put in more and more money to make up the shortfall. This will harm growth, as instead of using money to grow their business, QE is forcing them to divert resources into their pension funds.

Some companies will go bust as a result of rising pension deficits.

Some companies will be unable to cope with the costs of supporting their pension scheme and may end up going bust as a result. This would mean that members of the scheme get reduced pensions when they enter the Pension Protection Fund. Both these factors damage growth.

QE is designed to create inflation which is bad for savers and growth.

The aim of QE is to stave off 'deflation'. In other words to print new money that will create inflation. With UK consumer prices already rising well above the Bank of England's 2% target, it seems very odd to be pumping more money into the economy now. The effect of the combination of high inflation and ultra-low interest rates (as the Bank of England forces interest rates down via QE) is toxic for savers. Interest rates are below inflation rates, so each year the value of their savings falls. And 90% of pensioners have bought a fixed annuity which pays an income that does not increase in line with inflation. So, as inflation rises each year, they become poorer and poorer. This will harm longer term growth, as the over 65s become an ever-increasing proportion of the population.

The aim of QE is to stave off 'deflation'. In other words to print new money that will create inflation. With UK consumer prices already rising well above the Bank of England's 2% target, it seems very odd to be pumping more money into the economy now. The effect of the combination of high inflation and ultra-low interest rates (as the Bank of England forces interest rates down via QE) is toxic for savers. Interest rates are below inflation rates, so each year the value of their savings falls. And 90% of pensioners have bought a fixed annuity which pays an income that does not increase in line with inflation. So, as inflation rises each year, they become poorer and poorer. This will harm longer term growth, as the over 65s become an ever-increasing proportion of the population.Tuesday, 21 February 2012

Tuesday, February 21, 2012

Posted by Jake

No comments

Labels: banks, Bonus, executive, FSA, OFT, pay, regulation, sales techniques

Saturday, 18 February 2012

Saturday, February 18, 2012

Posted by Jake

1 comment

Labels: Article, Bank of England, banks, Big Society, British Bankers Assoc, credit crunch, inequality, Osborne

Project Merlin, the deal done by the banks in 2011 to avoid harsher government treatment for causing the Credit Crisis, would have more aptly been titled Project Morgana, known to viewers of the BBC's Camelot-inspired television series for her pitiless pouting treachery. The treachery in Project Merlin comes from all sides: the treachery of the banks for keeping their promises while not doing what they promised to do; the treachery of the government for knowingly (or was it incompetently?) offering terms and conditions that were as constraining to the banks as a spiders web to a witch’s pet spider-eating cat. Promising to lend much more, the banks lent much less, and yet surpassed the witless target set by the government.

Project Merlin, the deal done by the banks in 2011 to avoid harsher government treatment for causing the Credit Crisis, would have more aptly been titled Project Morgana, known to viewers of the BBC's Camelot-inspired television series for her pitiless pouting treachery. The treachery in Project Merlin comes from all sides: the treachery of the banks for keeping their promises while not doing what they promised to do; the treachery of the government for knowingly (or was it incompetently?) offering terms and conditions that were as constraining to the banks as a spiders web to a witch’s pet spider-eating cat. Promising to lend much more, the banks lent much less, and yet surpassed the witless target set by the government. Banks who had promised to lend £190 billion to British businesses as part of Project Merlin were able to claim, vaguely truthfully, that they exceeded the target and lent £214.9 billion. Even when the amount the banks actually lent, using the word 'lent' in its usual form as understood by the Bank of England, was only £99.9 billion. The Bank of England, gentlemanly as ever, published the Merlin figures of £214.9 billion (which includes undrawn facilities and rolled-over loans), and just below published their own £99.9 billion figure (actual loans given to businesses) describing it rather coyly as "alternative measures of lending".

Bank of England: Lending to UK businesses by the five major UK banks (£ billions)

'Project Merlin' data

2011 Q1 | 2011 Q2 | 2011 Q3 | 2011 Q4 | 2011 Total2 | |

| Gross lending facilities3 | 47.3 | 53.0 | 57.4 | 57.2 | 214.9 |

| o/w gross lending facilities to SMEs4 | 16.8 | 20.5 | 18.8 | 18.9 | 74.9 |

2011 Q15 | 2011 Q26,7 | 2011 Q38 | 2011 Q4 | |

| Gross lending9 | 26.7 | 24.3 | 23.9 | 25.0 |

| Net lending10 | -2.8 | -3.7 | -0.1 | -3.0 |

This successful failure made the headlines for a scant few days and is already forgotten. So we at Ripped-off Britons will continue to remind you that governments of all complexions treat us as the lawful prey of the banks. Something to remember as the Chancellor plans, in the next budget, to hand further "credit easing" billions to the banks trusting(!) them to reduce borrowing costs to British business.

It would be unfair to accuse the banks of deliberately lying. There is no deliberation: they have little interest in whether what they say is true or not. A consequence of waving big bonuses at people who are excessively motivated by money. When banks offer 'high interest', 'low risk', 'low cost', 'alpha', 'prosperous retirement' they don't mean what they say, nor does the law require them to mean it. Nor did they mean what we thought they said when they promised as part of Project Merlin to lend £190 billion to British businesses in 2011.

What the banks actually did was 'make available' £214.9 billion. Half of which was never actually borrowed. It was 'made available' to companies who didn't want the money, or on terms and interest rates that were too horrible. It was not because the demand didn't exist. The Federation of Small Businesses' survey, taken in November 2011, showed that 60% of members surveyed resorted to other sources of finance to grow their businesses, including credit cards, friends, personal savings and inheritances. We wonder why the Confederation of British Industry (CBI) applauded the banks on this accounting trick, rather than calling them to account. We will look into that in a separate blog.

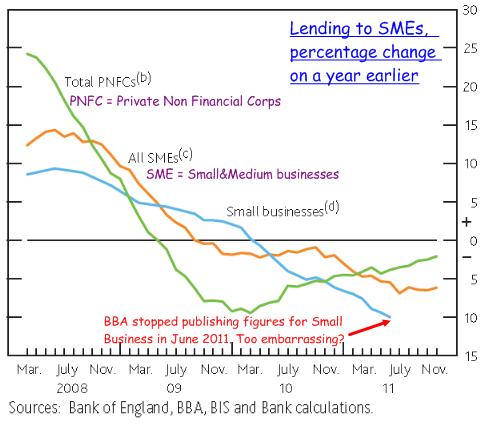

The Bank of England’s graph exposes the continuing slump in lending during 2011. Note the British Banking Association (BBA) stopped publishing figures for lending to Small Businesses in June 2011 – too much smoke coming from that gun. And yet the banks were able to boast about their increased lending, thus reducing political pressure to do anything. The Bank of England's figures show that actual new lending to UK businesses was £100 billion, well below the Merlin target.

The Bank of England’s graph exposes the continuing slump in lending during 2011. Note the British Banking Association (BBA) stopped publishing figures for lending to Small Businesses in June 2011 – too much smoke coming from that gun. And yet the banks were able to boast about their increased lending, thus reducing political pressure to do anything. The Bank of England's figures show that actual new lending to UK businesses was £100 billion, well below the Merlin target.Comments by bank executives reported in the Guardian newspaper include:

- Barclays: Bob Diamond claimed lending to all non-financial businesses was up 3%.

- Lloyds: Claimed to have exceeded its £11.7 billion target lending to small businesses by £0.8 billion.

- Santander and HSBC: Both claimed to have exceeded targets.

- RBS: Stephen Hester said RBS, which missed its target, lent more than twice all its rivals combined. "Forget Project Merlin and how it's defined - that's damned impressive," he said.

Successes are claimed by the banks, and used to justify bonuses, yet actual lending to SMEs fell at a faster rate than the previous year.

So what was Project Merlin all about? The government needed an excuse to give voters for doing nothing, including not repeating the bumper 2009 tax on bank bonuses. And the banks were happy to submit to a deal that required them to do nothing. The core aim for both banks and government was to make a promise to increase lending to British industry that could be achieved without actually increasing lending to British industry. This was done in the following weasel words taken from the agreement:

“the five banks have agreed to make available the appropriate capital and resources to support gross new lending to UK small and medium sized businesses that is 15% higher than what was delivered in 2010 should their efforts to foster demand succeed above and beyond their current expectations. That will put in place for 2011 new committed lending capacity of £76 billion for UK small and medium sized businesses, which is materially higher than both the actual gross new lending delivered by the five banks in 2010 of £66 billion and the banks’ revised expectations for 2011.”

The chancellor, George Osborne, responded to this offer:

“I welcome this unprecedented industry initiative, and am grateful for the considerable work that has gone into producing it.”

The barn-door sized loophole being the words “make available”. It's like a private sports club seeking public funds by pledging to ‘make available’ their facilities to the hoi-polloi but failing to give anybody the key to the gate.

The Bank of England report released in February 2012 seems to show that the banks exceeded their target of lending £190 billion, showing a total of £214.9 billion. However a look at the notes in the Bank of England's press release reveals that this is money 'made available', rather than money actually loaned. It was either 'made available' to companies who didn't want it, or on terms too horrible for companies to accept it. It also included 'rollovers', i.e. renewals of existing loans rather than new money.

Another skeleton peeping out of the cupboard is the 'net lending', which includes the money the banks took back from businesses. Far from £214.9 billion being lent to businesses, the banks actually took back nearly £10 billion more than they lent. The net effect is that the banks' lending over 2011 actually reduced.

Not wanting to look any more of a fool than nature intended, the Chancellor declined to renew the lending targets for 2012. He opted instead for a 'credit easing' strategy', in which the government gives the banks a subsidy which they trust the banks will pass on to SMEs.

Trust? Banks?! The way villains get away with their schemes in television dramas, like Merlin, would be entirely implausible but for the fact that it happens all the time in real life. Morgana stabs you in the back every episode, and still you trust her! But more on Credit Easing another time.

Friday, 17 February 2012

Friday, February 17, 2012

Posted by Jake

No comments

Labels: Cameron, politicians, the government, Tories

Scotland's First Minister Alex Salmond is campaigning for Scottish independence from Britain. But what if oil is discovered off the coast of the Falkland Islands (or Las Malvinas as the Argentines like to call it)?

Friday, February 17, 2012

Posted by Jake

2 comments

Labels: Article, banks, Big Society, British Bankers Assoc, CBI, inequality, Osborne, pay

Big industry has an inglorious track record of celebrating missed targets, and rewarding the missers with garlands of cash. In its press release the Confederation of British Industry (CBI) celebrated the efforts of the banks missing the Project Merlin targets, which had been agreed with the government for lending to small and medium enterprises (SMEs). The CBI blamed increased regulation for the shortfall. Are they suggesting that if only banks were less regulated it would be so much better?

When Evan Davis, presenter of Radio 4's Today Programme on 31st August 2011, wondering about the CBI's single minded opposition to changes in bank regulation, suggested to the CBI director general, John Cridland, that he is a paid spokesman for the banks, Cridland responded:

Cridland's claim that there was "no division" among his over 240,000 members on opposing bank reform should be taken liberally salted. "No division" only happens in societies which ignore part of their membership.

So, does the CBI ignore part of its membership? Small and Medium businesses employ 58.8% of all private sector workers, and generate 48.8% of all private sector turnover. In spite of their major part in British Industry SMEs only have 10% of the seats reserved in the CBI's Chairmen's Committee which sets CBI policy, including its approach to banks.

So, does the CBI ignore part of its membership? Small and Medium businesses employ 58.8% of all private sector workers, and generate 48.8% of all private sector turnover. In spite of their major part in British Industry SMEs only have 10% of the seats reserved in the CBI's Chairmen's Committee which sets CBI policy, including its approach to banks. Perhaps this is why the CBI behaves like the golem of the FTSE100, backing gouging financial, energy, and other mega companies regardless of the rip-off effects on even the CBI's own business members let alone us ordinary ripped-off Britons. As Sir Roger Carr, CBI President, said in his article in the Sunday Telegraph, "Let's end the executive greed debate and focus on growth." Oblivious to, or overlooking, the fact that executive greed is one of the greatest drivers of rip-offs that hamstring prosperity and growth for British businesses and for ordinary Britons.

SMEs are the Cinderellas of the CBI, with the big FTSE companies playing the ugly sisters. The average pay of SME directors is a tiny fraction of the average for their FTSE100 brethren , as they prefer to plough profit back into their companies rather than extract it for themselves. Perhaps CBI luminaries would rather have the executives of large international companies sitting round the table when their own salaries are set ? Better than having to chow down with directors of SMEs?

Even the British Bankers' Association's own figures show that lending to small businesses was lower in every month of 2011 compared to the equivalent month in the previous two years. The BBA decided to stop publishing the figures in June 2011, perhaps because they were too revealing.

The FSB (Federation of Small Businesses), in a survey from February 2010, reported that in spite of record low base rates, 32% of its members saw the cost of their business loans rise.

Another Federation of Small Businesses' survey, taken in November 2011, showed that 60% of its members surveyed resorted to other sources of finance to grow their businesses, including credit cards, friends, personal savings and inheritances.

Another Federation of Small Businesses' survey, taken in November 2011, showed that 60% of its members surveyed resorted to other sources of finance to grow their businesses, including credit cards, friends, personal savings and inheritances.

And nothing but a hearty hoorah for the banks from the CBI.

Something the Chancellor should bear in mind as he takes advice on presenting his back to the knife-wielding banks for his Credit Easing 'big idea'. This involves the government providing the banks with a subsidy, in the form of loan guarantees, which the government trusts the banks to pass on in lower costs to SMEs.

When will chancellors past and present ever learn?

Tuesday, 14 February 2012

Tuesday, February 14, 2012

Posted by Jake

1 comment

Labels: Article, Bank of England, Comment, Inflation, Osborne

The day before Valentine's day, Mervyn had written to George saying: Dear Chancellor...

"With external price pressures diminishing, and the underlying weakness in domestically generated inflation likely to persist, the Committee's assessment of the inflation outlook at its February meeting was that, in the absence of further policy action, the balance of risks around the inflation target in the medium term lay to the downside"....."The unwelcome combination of sluggish growth and high inflation over the past two years is a reflection of the need for the economy to rebalance following the financial crisis and associated deep recession, together with rises in the costs of energy and imports. Although inflation is now falling broadly as expected, the process of rebalancing still has a long way to go"

Yours Sincerely, Mervyn King

George responded on Saint Valentine's day:

Dear Mervyn....

"it was more likely than not that inflation would undershoot the 2% target. This is why I increased the ceiling of asset purchases financed by the issuance of central bank reserves from £275billion to £325billion"..."You have explained that the combination of sluggish growth and high inflation over the past two years is a reflection of the need for the economy to rebalance following the financial crisis and associated deep recession.....the process of rebalancing has a long way to go. I note and agree with this analysis"

Best Wishes, George.

Stripping away all the highfalutin economic poesy, this boils down to:

a) Inflation is in danger of falling too low! To devalue money, and push inflation up a bit, £50billion has been printed and handed to the banks.

b) Sluggish growth and high inflation is needed to rebalance the economy.

c) Sluggish growth and high inflation is going to continue for a long time.

Nice to see they get along. But what about the rest of us?

Tuesday, February 14, 2012

Posted by Jake

No comments

Labels: Big Society, Bonus, executive, inequality, pay, UK Uncut

Sunday, 12 February 2012

Sunday, February 12, 2012

Posted by Jake

2 comments

Labels: Article, banks, Bonus, FSA, Osborne, pay, taxation

With ministers spinning like duplicitous tops striving to show they are friends of business while simultaneously seeking electoral cheers for being beastly to bonus-takers, it is worth thinking what makes a 'true friend'. And how politicians can gain electoral advantage by actually being true friends of business. After all, a true friend helps you live up to your highest potential, not to indulge your basest instincts. The first thing is to expose the fallacy that if excellence brings rewards, then those who are rewarded must be excellent. Examples to the contrary abound, so you would have thought this would be an easy exposé.

Fred Goodwin got away with his multi-million pound severance rewards in spite of ruining the bank he ran because his contract said he could and, according to Lord Myners, the RBS board "bent over backwards" to ensure he did. Stephen Hester won his £1million bonus (which he was forced to decline by public opinion) in spite of the miserable performance of the bank he runs because, he said, the miserable state was his predecessor Goodwin’s fault and not his. Millions paid for Goodwin’s failure and for Hester’s lack of success.

Fred Goodwin got away with his multi-million pound severance rewards in spite of ruining the bank he ran because his contract said he could and, according to Lord Myners, the RBS board "bent over backwards" to ensure he did. Stephen Hester won his £1million bonus (which he was forced to decline by public opinion) in spite of the miserable performance of the bank he runs because, he said, the miserable state was his predecessor Goodwin’s fault and not his. Millions paid for Goodwin’s failure and for Hester’s lack of success.

Although Hester was forced to decline his bonus, the RBS 2010 Annual Report shows he is still due to receive his 'long term incentive award' which is worth more. In any case, it is reported that he has already collected £11million since joining RBS in 2008. So no need to shed any tears. Asked by James Naughtie, of BBC Radio 4's Today Programme, whether he would work less hard if he was only paid his basic salary of £100,000 a month (£1.2million a year), Hester conducted a masterclass in slipping around the question. Confirmation that the greasy pole is still lubricating the highly compensated executives clambering up it.

So what does being ‘business friendly’ actually mean? We are told by ministers and lobbyists that it is about keeping business regulation light, operating costs low, and executive pay high. But is that true? And surely it is not ‘business’ that is our national goal but ‘prosperity’. Business is undoubtedly one route to prosperity, but turning the route into the goal is like a premier league footballer pulling his shirt over his head in celebration before he gets to the half-way line instead of waiting until the ball is in the net.

Business is not short of friends. The Confederation of British Industry, “the UK's top business lobbying organisation”, whose “lobbying and campaigning helps keep business interests at the heart of policy in Westminster”, is remarkably effective at keeping business’s pals in line. And successful in redefining what ‘success’ is. John Cridland, CBI Director General, said

Cridland seems to follow the ‘celebrate at the half-way line’ philosophy, with remuneration committees of major UK companies setting bonus targets at achieving average (median) performance (i.e. they only have to perform at or above the average for their sector to get their huge bonuses). Nonetheless, the CBI successfully gets its business pals to stand obediently in line:

- The Financial Services Authority (FSA), and its successor the Financial Conduct Authority (FCA), provides the weak regulation in the financial sector with fines mere peppercorns compared with profits. Should we be worried that the ‘new’ FCA copied the discredited FSA’s goal for consumer protection: to secure “an appropriate degree of protection for consumers”. Appropriate for whom?

- The courts enforce the weak consumer protection law as defined by our parliament, which effectively allows half of consumers to be duped quite legally.

- The politicians provide strong words where they can’t do anything (it is shareholders’ responsibility to control runaway pay), and weasel words when they can (declining to vote our shareholding against bumper remuneration in RBS and Lloyds Banking Group claiming it would be 'interfering')

Low business costs, weak regulation, and high executive pay are certainly “business friendly”, but are they “prosperity friendly”?

When the banks say greater regulation would impose higher costs, they mean that part of their profits would ‘leak’ to other people – those who are needed to put the regulation in place, from accountants and computer systems staff to the catering and cleaning staff who have to feed and clean up after the extra accountants and computer programmers.

When they say ring-fencing the banks will drive up costs, they mean that if they can’t use their retail depositors’ savings, paying them virtually zero interest, to fund their investment bank they would have to pay more for their funds. “Pay more” means paying their retail depositors (that's you and me) more interest on our savings.

When they say high executive pay is needed to attract “premier goal scorers”, their claims are a miasma of fibs, smoke and mirrors. Click on each to see the reality:

- Are exceptionally bright?

- Have the talent to perform consistently excellently?

- Be prepared to take risk, and be prepared to pay the price when it goes wrong?

- Prevent them being seduced overseas by even higher pay?

- Provide great returns to shareholders?

- Provide excellent service to customers?

Consider the claim that highly paid executives take high risks. Executives in the big companies rarely risk substantial quantities of their own assets. They risk their shareholders’ money, their employees’ livelihoods, and their customers who rely on whatever goods or services they provide. The mere fact that they are overly bonussed means that even being fired is not a risk as was demonstrated by the comfortable retirement of many senior bankers including Mr.Goodwin. Goodwin’s contract with RBS allowed him to:

- Start drawing his pension at the age of 50, with all payments up to his 60th birthday being added to the pot by RBS when he was ejected.

- Even though he joined RBS at the age of 40, additional payments were dropped into the pot to cover him from the age of 20.

- His pension was based on not his ‘final salary’, but the salary in any year he chose in the previous decade. (This is important for bankers, whose pay can fluctuate from the exorbitantly high to the ridiculously high)

- He was allowed to keep all the pensions he had accrued for what he actually did between the age of 20 to 40 working for other companies.

Talented executives should be highly paid. But the pay should be enough for them to pay their bills month by month, like the rest of us. Their bills may be much higher - caviar, supercar, paramour - but they should rely on next month's salary to pay for next month's excesses. That way they will nurture their companies like milk-cows which need long healthy lives rather than prepare them for the riskier existence of beef-cows which only need to survive long enough to provide them with their next bonus-steak dinner.

There is no greater driver of rip-offs than offering a lifetime's pay and ‘rewards’ for a year's work. To justify their bonuses executives strive to show more profits. Profits don’t appear from nowhere: they come from the pockets of us ripped-off Britons. If there aren't enough legitimate profits, there are other ways to catch a bonus:

There is no greater driver of rip-offs than offering a lifetime's pay and ‘rewards’ for a year's work. To justify their bonuses executives strive to show more profits. Profits don’t appear from nowhere: they come from the pockets of us ripped-off Britons. If there aren't enough legitimate profits, there are other ways to catch a bonus:

- Payment Protection Insurance

- Savings teaser rates that quietly drop to nothing

- Energy prices

- Rip-off pension fees

- Excessive public transport costs

- etc

Is it thoughts of their million pound bonuses that drive executives to rip out 50% of the value of our pensions with excessive charges, consigning pensioners to poverty? Is it their long-term incentive plans that persuade directors to increase their margins leaving millions in fuel poverty contributing to an estimated 22,000 additional deaths among over 65s in the winter of 2010-11?

It is not just us ripped-off Britons as individuals that are injured. Rip-offs by businesses damage other businesses. Excessive energy costs, extortionate banking costs, extreme travel costs all serve to hamstring British industry. The financial sector offering higher pay, funded by its excessive profits, to computer programmers and accountants pushes up the market rate for all industries who need programmers and accountants. Offering excessive pay tempts in talent which is lost to other industries.

Clearly, being 'business friendly' is not just a matter of giving businessmen whatever they want. No more than being 'child friendly' is just a matter of letting your kids do whatever they want. A certain type of businessman and most children want you to think otherwise. Politicians and parents should know better.

How times have changed. As little as 30 years ago, the directors of the main British companies earned around 15 times more than the average member of staff. Now, according to the High Pay Commission, they take many times more. Were the corporate titans of 1980 so much inferior to their successors today?

It is not just us ripped-off Britons as individuals that are injured. Rip-offs by businesses damage other businesses. Excessive energy costs, extortionate banking costs, extreme travel costs all serve to hamstring British industry. The financial sector offering higher pay, funded by its excessive profits, to computer programmers and accountants pushes up the market rate for all industries who need programmers and accountants. Offering excessive pay tempts in talent which is lost to other industries.

Clearly, being 'business friendly' is not just a matter of giving businessmen whatever they want. No more than being 'child friendly' is just a matter of letting your kids do whatever they want. A certain type of businessman and most children want you to think otherwise. Politicians and parents should know better.

How times have changed. As little as 30 years ago, the directors of the main British companies earned around 15 times more than the average member of staff. Now, according to the High Pay Commission, they take many times more. Were the corporate titans of 1980 so much inferior to their successors today?

The wealth of the nation continues to grow, and yet everyone has been taken in by the fallacy that the nation cannot afford to pay for public services such as health, education, defence, and policing. The nation has been gulled into believing that final salary pensions are not affordable, and that everyone will have to work until they are much older. The reality is the share of GDP going in pay and pensions is actually dropping. And yet Ripped-off Britons are being persuaded that they must expect even less.

The wealth is there, but a greater share of the nation's wealth is being confiscated by the wealthy.

The wealth is there, but a greater share of the nation's wealth is being confiscated by the wealthy.And it is being done under the pretence that the current tawdry version of “Business Friendly" is the same thing as “Prosperity Friendly”.

Which it isn’t.

Which it isn’t.

Friday, 10 February 2012

Friday, February 10, 2012

Posted by Jake

4 comments

Labels: Big Society, HMRC, inequality, sports, taxation, the courts

Tuesday, 7 February 2012

Tuesday, February 07, 2012

Posted by Jake

1 comment

Labels: banks, credit crunch, FSA, inequality, regulation

Sunday, 5 February 2012

Sunday, February 05, 2012

Posted by Jake

11 comments

Labels: Article, benefits, Big Society, budget cuts, housing, inequality, property

Gerrymandering, the process of gaining electoral advantage by changing the demographics (the type of voters) in a constituency, is a tactic used by some of the best democracies - the worst resorting to the much simpler ballot-box stuffing technique. There are two obvious ways of manipulating the demographics:

The first is to move the boundaries of the constituency to exclude those you don't want and envelope those you do.

This "re-districting" is a favorite tactic in the USA, with its meandering congressional districts exemplified by Congressional District 12 in North Carolina. In 2003 the "Texas Eleven", eleven state senators, went on the run to prevent the state senate having a quorum to pass a re-districting that would gnaw on their own electoral prospects.

The other way, instead of moving electoral boundaries to include/exclude certain voters, is to move the voters. Westminster City Council tried this in the 1990's. According to Hansard, the leader at that time, Dame Shirley Porter, prepared a note for the then Prime Minister

“We in Westminster are trying to gentrify the City. We must protect our electoral position which is being seriously eroded by the number of homeless we are being forced to rehouse . . . I feel that the problem is so serious you should look at this yourself . . . I am afraid that unless something can be done, it will be very difficult for us to keep Westminster Conservative”

Which is one consequence - intended or unintended - of the £26,000 benefits cap rushing through parliament. This time not restricted to a single city council.

By including rents in this cap, the inevitable consequence is that families on benefits will have to move to cheaper areas. Within London, and within the nation:

This proposal brings potential benefit to both Labour and Conservative parties by concentrating their presumed supporters.

Less clear how this helps the Lib-Dems though.

Sunday, February 05, 2012

Posted by Jake

1 comment

Labels: Article, banks, credit crunch, HMRC, inequality, pay, taxation

Do private equity fund managers get paid loads because they are so good at rescuing failing businesses? Fund managers don’t make their money only by gouging fees from their clients. With a little help from their friends at Her Majesty’s Revenue & Customs, they have had various other cosy little arrangements. One of these is in the form of “carried interest”. HMRC came to an agreement with the British Venture Capital Association in 2003 that cleared the way for 'leveraged buyouts'. As a result of this little understanding, made in the midst of the boom in easy credit, naïve wannabe homeowners were joined by hi-jacked companies in their irrationally exuberant borrowings.

What may have been a worthy idea for true ‘angelic’ venture capitalists – investing money into risky infant companies with lots of ideas and no assets – was pounced upon by the leveraged buy-out outfits unashamedly flying the Jolly Roger.

The terms of the Memorandum of Understanding are so specific it seems that the boys from the BVCA couldn’t believe what was being offered to them, and needed it spelled out:

“So, you are saying I can sharpen a stick? You know, the long thin things you get off a tree? And I can poke it into your eye? Left and/or right? Those two round things just above your nose? And you are fine with that? Can you right that down for me, just to be sure.”

So HMRC wrote it down. The Inland Revenue’s Memorandum of Understanding states:

“The carried interest holders will contribute capital so as to ensure that they have 20% of the total capital contributions such that, after repayment of the loans and the preferred return (see below), they become entitled to a 20% share in the net profits if the fund is successful.

For example, in a fund of £100 million of investor money the investors might subscribe for capital of £10,000 and loan commitments of £99,990,000. The carried interest holders will subscribe (usually via another partnership or by the assignment methods - see paragraph 7.7 for capital of £2,500 which will then represent 20% of the total capital contributions of £12,500 (£10,000 from the outside investors and £2,500 from the carried interest holders).”

In plainer English, if the above isn’t plain enough, the partners of a private equity fund are allowed to own 20% of the profits and assets of a £100million fund for a payment of £2,500. And if that isn’t enough, the way capital gains are taxed in Britain means our jolly fund manager doesn’t need to pay any tax on the boom in his assets.

Of course, sitting on £99,990,000 of debt is uncomfortable for most people – except for those who are willing and able to unload it onto a captive company. The model for a leveraged buyout:

a) Set up a fund of £100 million, made up of £2,500 from the fund managers, £10,000 from investors conditional on the investors also lending a further £99,990,000. Total funds = £100million from investors (who now own 80% of the fund), £10,000 from fund managers (who now own 20% of the fund).

b) Buy a company for £100 million.

c) Now that you are in control of the company, get it to borrow £99,990,000.

d) You then get the hostage company to pay you £99,990,000 as a ‘special dividend’

e) Voila! A £100million company that once belonged to someone else now belongs to your fund. And you own 20% of it, for the princely sum of £2,500.

Fund managers don’t know how to rescue businesses. Their knowledge of food manufacturers, furniture makers, and car manufacturers is limited to what can be found in their kitchens, bedrooms, and garages. Fund managers do know how to spot a company that is healthy enough to convince banks and other investors to lend it lots of money. Fund managers know how to extract the money in the form of special dividends.

So long as the company is able to support the debt, the fund can continue to collect the profits or can sell the company on to another investor. If the company collapses under the weight of its borrowings, the fund just loses the £10,000 it put up and walks away.

Nice work if you can get it.

Nice work if you can get it.

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

Priority

property

protests

public sector

Puppets

Ready

regulation

retailers

Roundup

sales techniques

series

SFO

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

UK Uncut

unions

Vince

water

Archive

-

▼

2012

(213)

-

▼

February

(15)

- KJ's friend defends his role at welfare-to-work fi...

- How the government policy of Quantitive Easing and...

- Former Lloyds CEO Eric Daniels has his bonus clawe...

- Banks' promises to lend to British businesses disa...

- Scottish independence and the oil question!

- Why isn't the CBI tougher on banks for failing to ...

- Valentine's day letter from chancellor of the Exch...

- Corporate bosses deserve their millions

- Why we should be business-friendly, and what makes...

- Harry Redknapp used Monaco tax haven to dodge his ...

- Payday loans: never a borrower be

- Benefits cap of £26,000 - could this be a Great Br...

- How HMRC allowed private equity partners to multip...

- Here's why Lansley won't give up his NHS reforms

- Liebrary: Honours are an honour? Banking honours s...

-

▼

February

(15)

Powered by Blogger.