Posted by Jake on Friday, February 17, 2012 with 2 comments | Labels: Article, banks, Big Society, British Bankers Assoc, CBI, inequality, Osborne, pay

Big industry has an inglorious track record of celebrating missed targets, and rewarding the missers with garlands of cash. In its press release the Confederation of British Industry (CBI) celebrated the efforts of the banks missing the Project Merlin targets, which had been agreed with the government for lending to small and medium enterprises (SMEs). The CBI blamed increased regulation for the shortfall. Are they suggesting that if only banks were less regulated it would be so much better?

When Evan Davis, presenter of Radio 4's Today Programme on 31st August 2011, wondering about the CBI's single minded opposition to changes in bank regulation, suggested to the CBI director general, John Cridland, that he is a paid spokesman for the banks, Cridland responded:

Cridland's claim that there was "no division" among his over 240,000 members on opposing bank reform should be taken liberally salted. "No division" only happens in societies which ignore part of their membership.

So, does the CBI ignore part of its membership? Small and Medium businesses employ 58.8% of all private sector workers, and generate 48.8% of all private sector turnover. In spite of their major part in British Industry SMEs only have 10% of the seats reserved in the CBI's Chairmen's Committee which sets CBI policy, including its approach to banks.

So, does the CBI ignore part of its membership? Small and Medium businesses employ 58.8% of all private sector workers, and generate 48.8% of all private sector turnover. In spite of their major part in British Industry SMEs only have 10% of the seats reserved in the CBI's Chairmen's Committee which sets CBI policy, including its approach to banks. Perhaps this is why the CBI behaves like the golem of the FTSE100, backing gouging financial, energy, and other mega companies regardless of the rip-off effects on even the CBI's own business members let alone us ordinary ripped-off Britons. As Sir Roger Carr, CBI President, said in his article in the Sunday Telegraph, "Let's end the executive greed debate and focus on growth." Oblivious to, or overlooking, the fact that executive greed is one of the greatest drivers of rip-offs that hamstring prosperity and growth for British businesses and for ordinary Britons.

SMEs are the Cinderellas of the CBI, with the big FTSE companies playing the ugly sisters. The average pay of SME directors is a tiny fraction of the average for their FTSE100 brethren , as they prefer to plough profit back into their companies rather than extract it for themselves. Perhaps CBI luminaries would rather have the executives of large international companies sitting round the table when their own salaries are set ? Better than having to chow down with directors of SMEs?

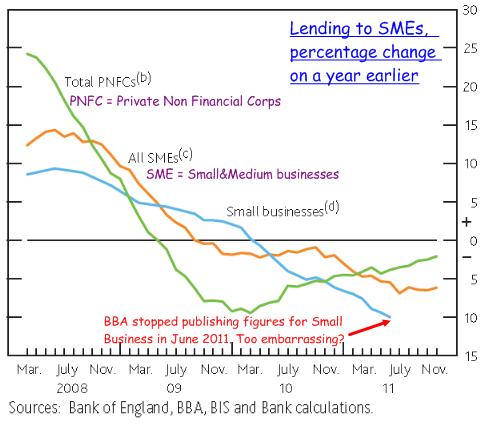

Even the British Bankers' Association's own figures show that lending to small businesses was lower in every month of 2011 compared to the equivalent month in the previous two years. The BBA decided to stop publishing the figures in June 2011, perhaps because they were too revealing.

The FSB (Federation of Small Businesses), in a survey from February 2010, reported that in spite of record low base rates, 32% of its members saw the cost of their business loans rise.

Another Federation of Small Businesses' survey, taken in November 2011, showed that 60% of its members surveyed resorted to other sources of finance to grow their businesses, including credit cards, friends, personal savings and inheritances.

Another Federation of Small Businesses' survey, taken in November 2011, showed that 60% of its members surveyed resorted to other sources of finance to grow their businesses, including credit cards, friends, personal savings and inheritances.

And nothing but a hearty hoorah for the banks from the CBI.

Something the Chancellor should bear in mind as he takes advice on presenting his back to the knife-wielding banks for his Credit Easing 'big idea'. This involves the government providing the banks with a subsidy, in the form of loan guarantees, which the government trusts the banks to pass on in lower costs to SMEs.

When will chancellors past and present ever learn?

Great article on a really important issue - in Wales were looking at the possibilities that public banking might offer to fund SMEs, as the 'Big 5' plainly don't see this as sufficiently bonus-generating or 'dynamic' to be worth their trouble. The FSB has produced some really good material on this, as has TUC Wales in combination with New Economics Foundation (nef) and Plaid Cymru have already placed a publically owned investment bank at the heart of their 'Plan C' for the Welsh economy.

ReplyDeleteWe've got to change these parts of "the system".

ReplyDeleteOrdinary people, and even many extra-ordinary people, should be able to buy the basic utilities

of life, in "governable space". NOT exclusively/increasingly from "private institutions" who's

goal is profit [and profit increase].

Therein lies the essence of slavery!

All these "private institutions" act on "rights in law", rights as entities to profit [etc]

But, do we want such entities to be able to profit on exchanging contracts, when it's *our*

money they're gambling with?

Do we need these "private entities" controlling and profiting from the necessities of *our*

basic resources [utilities/transport/justice/health/wealth/government] ?

I'm a private entity myself [sentient being], and I want that governable space so I can control my necessities.

governable space doesn't mean controlled, but it must be held to order, so should be in democratic hands [not corporate].

these "corporate identities" are interesting creatures in law, we share many rights; to exist and thrive being common. But they don't like human rights [as they have none themselves]

suspect the judiciary forgets this sometimes, and we do too, when we trust our taxes and services to them.

Great write! Thank you!