Posted by Jake on Sunday, December 16, 2012 with No comments | Labels: Article, Big Society, education, NHS

2012 saw a series of coruscating reports on callous nurses in British hospitals. Criticism was heard in Westminster when an MP compared her hospitalised husband’s final days with those of a battery chicken.

The Chief Nurse weighed in, as senior managers who find themselves in a sticky corner often do, calling for more measuring and targets. She announced that the "Five Cs" of nursing are to increase to "Six Cs", and will be measured. Care; Compassion; Commitment; Communication; Courage; Competence. Snarling nurses to be tamed by more Cs and more targets!

Among all the storm and stress a nurse speaking on a news programme made what is surely the key point: in recent decades compassion has shrivelled in Britain. Caring about the well being of our fellow Britons is not merely out of fashion, it is regarded as a game for mugs. To paraphrase an infamous tax dodger, "Compassion is for the little people". To be precise, not "for" as in the beneficiaries of compassion, but "for" as the responsibility: it is for the little people to be compassionate.

Compassion is about empathising with the suffering of others. But in Britain, the greatest rewards - knighthoods, peerages, and tax breaks - are reserved for those who profit from the suffering of others. No group is more profitable and more targeted than the poorer Britons. From a vast medley take just three examples: the government cuts benefits for the working poor to pay for top-rate tax cuts; banks impose excessive penalty charges on the unauthorised overdrafts of those who run out of money; energy companies take a poverty premium from gas and electricity meter users too poor to be trusted with a quarterly bill.

Companies actively use incentives to drive compassion out of their staff at all levels. The FSA released a consultation stating that corruption has eaten its way down to junior staff. Martin Wheately, Managing Director of the FSA and CEO designate of the Financial Conduct Authority (FCA, which will take over from the FSA as the new financial services regulator), said in his speech to senior bankers at a Thomson Reuters Newsmaker event

Company directors and government ministers think their little thefts go unnoticed. Certainly they are less visible than a distressed patient lying on a hospital trolley. And yet they only go unnoticed because we ordinary Britons choose to see and forget, or simply to ignore them.

The impact of these little thefts is actually visible everywhere, not least in the effect on the children of poor families. The Children's Society's "Food for Thought" report from December 2012 states:

Compassion is about empathising with the suffering of others. But in Britain, the greatest rewards - knighthoods, peerages, and tax breaks - are reserved for those who profit from the suffering of others. No group is more profitable and more targeted than the poorer Britons. From a vast medley take just three examples: the government cuts benefits for the working poor to pay for top-rate tax cuts; banks impose excessive penalty charges on the unauthorised overdrafts of those who run out of money; energy companies take a poverty premium from gas and electricity meter users too poor to be trusted with a quarterly bill.

Companies actively use incentives to drive compassion out of their staff at all levels. The FSA released a consultation stating that corruption has eaten its way down to junior staff. Martin Wheately, Managing Director of the FSA and CEO designate of the Financial Conduct Authority (FCA, which will take over from the FSA as the new financial services regulator), said in his speech to senior bankers at a Thomson Reuters Newsmaker event

“while public attention has been on the huge rewards on offer to the few, the effect of more modest rewards on the many needs to be dealt with….Incentive schemes on PPI were rotten to the core”

We looked at 22 firms of all sizes, including high street banks, building societies, insurance companies and investment firms. And what we found is not pretty. Most of the incentive schemes we looked at were likely to drive people to mis-sell to meet targets and receive a bonus

.. another firm allowed sales staff to earn a bonus of 100% of their basic salary for the sale of loans and PPI, but the bonus was only payable to those who had sold PPI to at least half their customers.”

Company directors and government ministers think their little thefts go unnoticed. Certainly they are less visible than a distressed patient lying on a hospital trolley. And yet they only go unnoticed because we ordinary Britons choose to see and forget, or simply to ignore them.

The impact of these little thefts is actually visible everywhere, not least in the effect on the children of poor families. The Children's Society's "Food for Thought" report from December 2012 states:

"Currently in England, 1.2 million school age children in poverty are not getting free school meals – 700,000 of them are not even entitled to this key support."

- Nearly three quarters (72%) of teachers surveyed have experienced pupils coming into school with no lunch and no means to pay for one

- Nearly half (44%) of those surveyed found that children are often or very often hungry during the school day

- Two thirds (66%) of the teachers surveyed stated that staff provide pupils with food or money if they come into school hungry.

And so the absence of compassion goes on:

The Hills Report on fuel poverty, published by the Department of Energy and Climate Change in March 2012, stated:

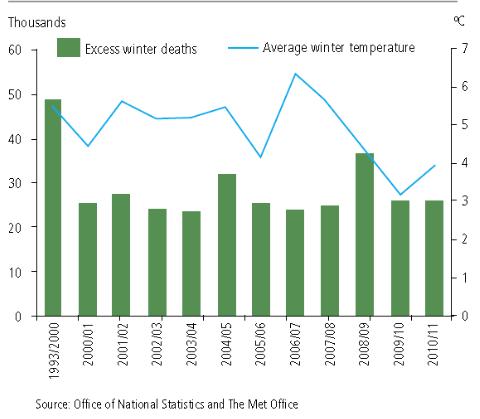

"From a health and well-being perspective: living at low temperatures as a result of fuel poverty is likely to be a significant contributor not just to the excess winter deaths that occur each year (a total of 27,000 each year over the last decade in England and Wales), but to a much larger number of incidents of ill-health and demands on the National Health Service and a wider range of problems of social isolation and poor outcomes for young people."

Final report of the Fuel Poverty Review, Professor John Hills

Final report of the Fuel Poverty Review, Professor John Hills

Retailers charging a poverty premium on the poorest:

The charities Save the Children and Family Action produced reports in 2010 and 2011 detailing how the poor pay more for the same stuff.

It is a shocking injustice that the poorest families in the UK pay higher prices than better-off families for basic necessities like gas, electricity and banking. The costs that poor families bear in acquiring cash and credit, and in purchasing goods and services, can amount to a ‘poverty premium’ of around £1,000 – 9 per cent of the disposable income of an average-size family.

And lots more:

British companies chased profit at the expense of compassion. Businesses were ruined; drug cartels' money was laundered; doctors were bribed to prescribe dodgy drugs:

- British banks, censured by the FSA, faced paying billions in restitution for scamming businesses into Interest Rate Swaps.

- HSBC was forced to apologise to the US government for laundering drug money, putting profit before probity and the misery of drug abuse.

- GlaxoSmithKline was fined US$3billion for selling dodgy drugs and bribing doctors to prescribe them.

"stunning failures of oversight – and worse – that led the bank to permit narcotics traffickers and others to launder hundreds of millions of dollars through HSBC subsidiaries" ....

“HSBC’s blatant failure to implement proper anti-money laundering controls facilitated the laundering of at least $881 million in drug proceeds through the U.S. financial system."

“HSBC’s blatant failure to implement proper anti-money laundering controls facilitated the laundering of at least $881 million in drug proceeds through the U.S. financial system."

When their compassion-less behaviour is pointed out, all the firms have the same answer: It happened a long time ago, and we are dealing with it. In relation to the money laundering, HSBC's CEO, Stuart Gulliver, stated

"The HSBC of today is a fundamentally different organisation from the one that made those mistakes. Over the last two years, under new senior leadership, we have been taking concrete steps to put right what went wrong and to participate actively with government authorities in bringing to light and addressing these matters."

HSBC's chairman of two years ago is the Reverend Lord Stephen Green (no, really, he actually is an ordained Anglican priest), who at the time of writing this post is a minister in the British government (I know, it is beyond parody. Reality threatens to drive us satirists out of business!).

The perpetrators of these compassion free acts don't go to jail. Fines are paid not by the perpetrators but by the shareholders. There are far more knighthoods and lordships, more Mercedes and Bentleys, more tax breaks, and more raw cash for the perpetrators of these compassion-less acts than among the nursing profession.

The perpetrators of these compassion free acts don't go to jail. Fines are paid not by the perpetrators but by the shareholders. There are far more knighthoods and lordships, more Mercedes and Bentleys, more tax breaks, and more raw cash for the perpetrators of these compassion-less acts than among the nursing profession.When I next find myself in a hospital trolley, I hope the nurses will show me compassion and kindness in spite of my irritable sarcastic nature which will no doubt be exacerbated by the discomfort and inconvenience.

But lack of compassion in hospitals is just a symptom. The core disease is the lack of compassion among the political and corporate leaders of Britain. And that is one disease that shows no sign of going away.

0 comments:

Post a Comment