Posted by Jake on Saturday, March 22, 2014 with No comments | Labels: Article, Austerity, Big Society, budget cuts, Graphs, HMRC, pay, pensions, taxation

“Find the pea” is a favourite street hustler trick. A pea is openly placed under one of three walnut shells, the shells are shuffled, and the pea reappears where it wasn't before.

“Find the pea” is a favourite street hustler trick. A pea is openly placed under one of three walnut shells, the shells are shuffled, and the pea reappears where it wasn't before.“Find the tax” works in the same way. You are shown the tax, then it disappears to return somewhere unexpected. A Taxpayers’ Alliance report produced in January 2013 stated the Conservative-LibDem government has implemented 2.5 times more tax rises than cuts since it came into power in 2010 (299 rises and 119 cuts). These include everything from cutting the highest rate of income tax from 50% to 45%, to adding VAT on to the rental of a chair in a hairdresser’s salon. (As the report was published in January 2013, subsequent tax changes aren’t included).

It is evident from these 479 tax shuffles that George Osborne is a pretty adept hustler. He knows it is best to do some things openly so people don't look too hard for the things he does under cover. He openly stated the VAT rise would bring in an additional £13 billion a year (a regressive tax, hitting the poor harder than the wealthy).

He was more-or-less open with his speedy cut to the 50% top tax rate. A cut made in time to enable the people affected to shift their income – moving it before and after the year of the 50%. A report by HMRC shows that billions of the “affected group’s” income disappeared in 2008-09 to reappear in the year before and the year after the life of the 50% rate.

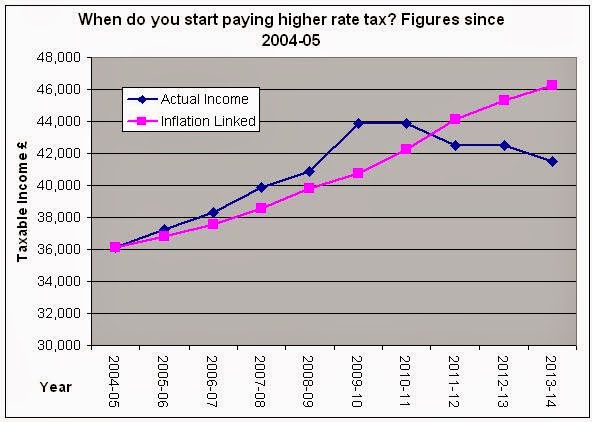

Somethings George does with curtains drawn and the lights switched off. The much trumpeted increase to £10,500 before people start paying income tax was the shuffle covering a doubling in the tax rate for people earning over £42,285. It had been the custom, between 2004 and 2010, for the threshold for higher rate tax to rise a bit faster than inflation.

However since 2010 this threshold has fallen, such that it is over £6,000 lower than inflation would require. Paying 40% instead of 20% on this £6,000 costs middle earners and extra £1,200 a year in taxes.

A report by the Institute of Fiscal Studies suggests that an extra 1.4 million people have been caught in the higher rate between 2010 and 2014.

For your edification, we offer two videos showing expert hustlers. We leave it to you to judge which is the more skillful:

***********************

0 comments:

Post a Comment