The 2014 European election result was shaped by the anger of ordinary people who have been misused to pay the price of the banking crisis. In the UK the Tories threw them out of the basket, the LibDems assisted with a sheepish smile, and Labour promised that if they were in power they would be doing the same thing in any case.

The 2014 European election result was shaped by the anger of ordinary people who have been misused to pay the price of the banking crisis. In the UK the Tories threw them out of the basket, the LibDems assisted with a sheepish smile, and Labour promised that if they were in power they would be doing the same thing in any case. The banking sector continues to be caught up in scandal after scandal, with no sign of reform or retribution beyond piffling fines. Other sectors, such as the energy industry, chase the banks’ scandalous profit levels by inflicting excessive prices on consumers.

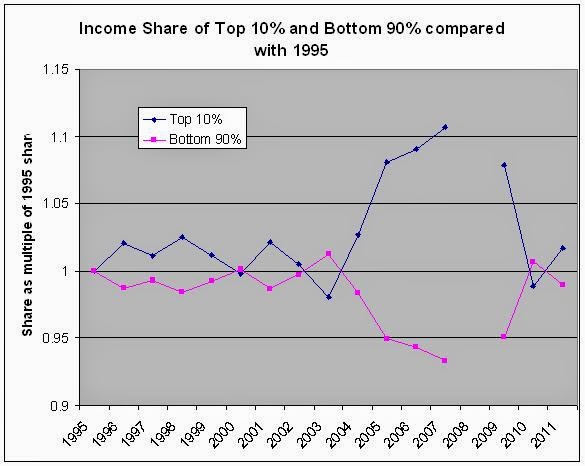

According to the Sunday Times Rich List the richest 1,000 people have doubled their fortunes since the financial crash. While in the name of ‘Austerity’ the incomes of the 90% have been frozen or cut, and the prospect of retirement has been pushed further into the distance with less money.

Actually, it isn't just the 90% who have been screwed. Figures from the Paris School of Economics, giving the share of national income going to different groups, do show that the top 10% did very well in the 5 years leading to the 2008 crash. But dig a little deeper and you find some surprising figures.

The enrichment of the top 10% masks

- how exceedingly well the top 0.05% have done,

- how really well the top 0.1% to 0.05% have done,

- how rather well the top 0.5% to 0.1% have done.

- how really badly the top 10% to 5% did.

Perhaps most suprisingly, the data shows the top 10% to 5% have done worse than the bottom 90%.

Now, as economic indicators recover to where they were before the banking crash the vast majority of us find ourselves marooned while the very wealthiest float off into greater prosperity. Corporate and personal tax cuts have been made by casting off large parts of public responsibilities into the hands of the private sector. Rights such as Legal Aid, free university education and welfare have been cut. Hospitals, schools, security, prisons, road sweeping and more have been outsourced and sold to the private sector where the wages of the many are lower and profits for the few higher. Cuts have been implemented by both Labour and Conservative that both parties promise to continue.

|

| Office of Budget Responsibility "Economic and Fiscal Outlook December 2013" |

“Government Consumption” includes money spent buying goods and services. It does not include payments such as benefits and pensions. Government Consumption includes paying for public services such as health, education, transport, justice, defence and the like.

In the year before the 2015 General Election we must remind ourselves how we have been sold out by successive governments. Politicians don't need reminding that they betrayed us, they are well aware of it. But they do need reminding that we know it, and for them to get our votes in 2015 they need to stop.