Posted by Hari on Saturday, May 17, 2014 with No comments | Labels: banks, energy, FCA, FSA, OFCOM, OFGEM, OFT, Priority, regulation

In May 2014 the energy regulator OFGEM boasted about its latest ‘record fine’: £12 million inflicted on E.on. OFGEM’s press release stated:

In May 2014 the energy regulator OFGEM boasted about its latest ‘record fine’: £12 million inflicted on E.on. OFGEM’s press release stated:- E.ON’s large scale mis-selling results in biggest supplier payout to consumers

- Ofgem found management arrangements were insufficient to protect against mis-selling

OFGEM has the power to fine upto 10% of revenue. E.ON’s UK revenue in 2013 was £9.9 billion. The £12million fine, about 0.1% of revenue, is not even a drop in that ocean of cash.

Money is the one thing that is not in short supply for Energy companies. They are awash with it. Fraudulent behaviour by our Energy and Financial sectors have been ‘punished’ by taking from them that which they have most of: money taken from their customers. Like fining Billy Bunter a doughnut – he may not like it, but he has plenty more. The loss of a doughnut will not reform him.

Money is the one thing that is not in short supply for Energy companies. They are awash with it. Fraudulent behaviour by our Energy and Financial sectors have been ‘punished’ by taking from them that which they have most of: money taken from their customers. Like fining Billy Bunter a doughnut – he may not like it, but he has plenty more. The loss of a doughnut will not reform him.Fraud is directed by people, not companies. Directors don’t fear fines – after all it is almost inevitably the company that pays them. But while they have more than enough money to brush off fines, they have about the same amount of time as anyone else. A year in jail is a year in jail, whoever you are.

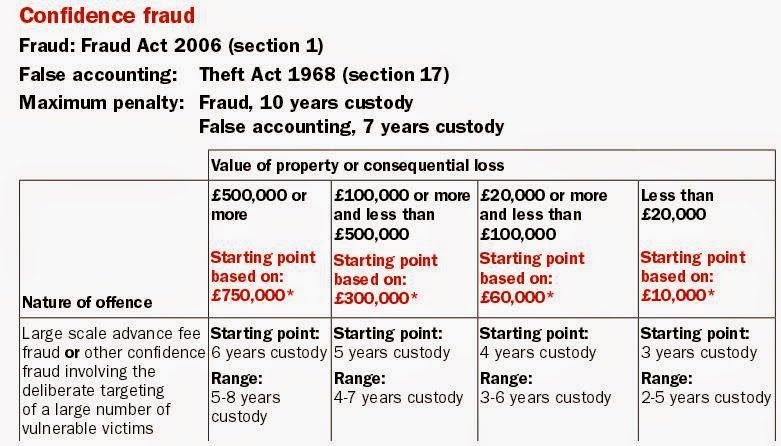

The Sentencing Council, appointed by the Lord Chief Justice and the Lord Chancellor of the UK, provides guidance to the British Justice System. Here is the guidance when it comes to frauds by ordinary citizens:

- "Confidence Fraud" (not unlike doorstep selling by energy companies) for sums of £500,000 or more: 5-8 years custody

- "Possessing, making or supplying articles for use in fraud" (not unlike PPI insurance products): 2-8 years custody

The Sentencing Council recommends a "benefits fraudster" convicted of taking more than £20,000 should face 18 months to 3 years in prison. And the Crown Prosecution Service (CPS) recommends that if a postman or an ordinary bank clerk pinches £17,500 he goes to jail for 21 months. On the other hand the directors of banks pinching billions in PPI fraud just get a bonus.

Here's what the CPS says in its "Guideline Breach of Trust Case"

R v CLARK [1998] 2 Cr.App.R. (S.) 95Save in very exceptional circumstances, where a person in a position of trust, for example an accountant, a solicitor, a bank employee or a postman has used his trusted and privileged position to defraud his partners, clients employers or the general public of sizeable sums of money immediate imprisonment is inevitable unless there are exceptional circumstances or the amount of money involved is very small. The amount defrauded is an important factor and the following guidelines apply where the sums involved are:

- Less than £17,500 up to 21 months imprisonment

- £17,500 to £100,000 2-3 years

- £100,000 to £250,000 3-4 years

- £250,000 to £1 million 5-9 years

- £1 million or more 10 years +"

Is there any doubt that a bit of jail time wouldn’t rapidly and abruptly stop the frauds by our bluest-chip companies?

Here are some more examples of multi-million pound scallywaggery that has been let-off with piffling penalties:

"SSE had put more than 20,000 customers on more expensive tariffs. It gave misleading scripts to its sales agents and most of their monitoring activity was carried out by line managers who received commission on the sales their reportees brought in. SSE’s senior management did not pay enough attention to what its people were doing on the ground. We fined SSE £10.5m."

"E.ON committed to pay back around £1.4 million to about 94,000 customers who were wrongly charged exit fees or overcharged after price rises. E.ON also agreed to make an extra goodwill payment of around £300,000 to a consumer fund they run with Age UK."

"In May 2012, we confirmed our decision on EDF, which we originally made in March 2012. EDF had acted in breach of its marketing licence conditions. We agreed measures with EDF worth £4.5 million to help vulnerable consumers."

In February 2014 the Financial Conduct Authority (FCA) reported that pensioners were losing up to £11 million each year, a cumulative £230 million over their retirements, due to poor annuities:

"we estimate that the improvement in annual income would be between £6m and £11m, and the lifetime benefit potentially available would be between £115m and £230m for the group of consumers buying annuities from their existing pension providers each year."

The banks have infamously paid billions in PPI compensation. In May 2014 the FCA website was saying:

.

“A total of £329m was paid in February 2014 to customers who complained about the way they were sold PPI. This takes the amount paid out since January 2011 to £14.3bn.”

..

0 comments:

Post a Comment